From Power Plant to Civic Renewal Centerpiece

The Future of Natural Gas: An Interdisciplinary MIT Study

ACSF and several other groups initiated and sponsored the report. The other groups included the MIT Energy Initiative (MITEI) members Hess Corporation and Agencia Naçional de Hidrocarburos (Colombia), the Gas Technology Institute (GTI), Exelon, and an anonymous donor. Gregory C. Staple, the Foundation’s CEO, served on the report’s 18-person advisory committee. Incoming Energy Secretary Ernest J. Moniz, former MITEI director, testified before the U.S. Senate Committee on Energy and Natural Resources about this report.

Full Report

Download PDF • Request Print Copy

In the Press

Ernest Moniz, MIT Physicist, Nominated as Energy Secretary: The Washington Post, March 4, 2013

An M.I.T. Plan for Natural Gas with Planet in Mind: New York Times, June 9, 2011

MIT: Natural Gas to Become More Entwined in US Economy: SNL Financial, June 9, 2011

Natural Gas Gives Edge to US Manufacturers: Financial Times, June 8, 2011

The Future of Natural Gas: Geology.com, June 28, 2010

Does Our Energy Future Line in Natural Gas?: Consumer Affairs, June 28, 2010

The Future of Natural Gas: RedOrbit, June 28, 2010

Offshore Drilling Uncertainty Likely to Boost Search for Onshore Deposits: allvoices, June 28, 2010

Study Says Natural Gas Use Likely to Double: New York Times, June 25, 2010

MIT Study Urges US Gas Industry to Back Price on Carbon Emissions: Platts, June 25, 2010

For Climate Relief, US Will Turn to Gas: Nature.com, June 25, 2010

MIT Researchers See Natural Gas as the Choice for Lower Carbon Emissions: New York Times, June 25, 2010

MIT: The Future Is A (Natural) Gas: Forbes, June 25, 2010

Natural Gas Seen as Key in a Carbon-Constrained Futuree: Greentech Media, June 25, 2010

MIT Releases Major Report: The Future of Natural Gas: PhysOrg.com, June 25, 2010

MITEI-Led Study Offers Comprehensive Look at The Future of Natural Gas: MIT News, June 25, 2010

Natural Gas Use to Double in US in Coming Decades: MIT Report: Treehugger, June 25, 2010

Lessons from Ohio: Building a Clean Energy Supply Chain

By Ed Weston and Mathew Bramson of WIRE-Net.

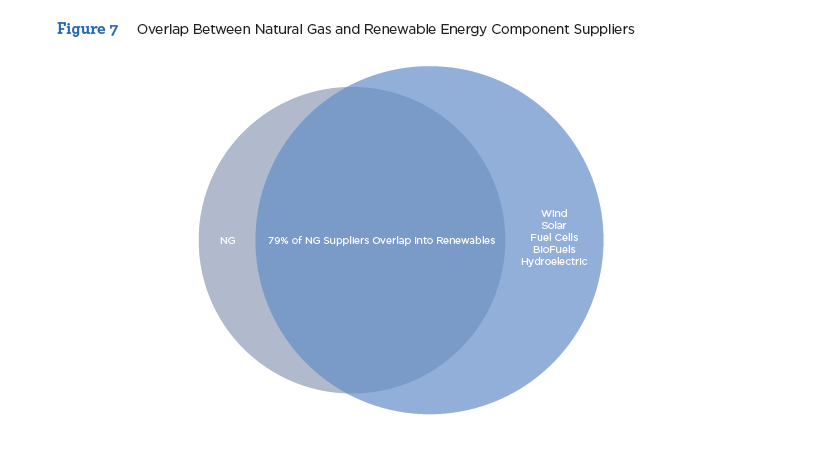

What has Ohio’s experience taught us about energy-related manufacturing in America? Work in energy is providing significant revenue to most manufacturers, especially those serving clean energy markets. Energy markets are also attracting investment in new machinery and facilities, which is creating good manufacturing jobs and the positive feelings about the energy drivers of these jobs. Read more.

Download Full Report (PDF) | Request Print Copy

Full Report

- Figure 7: Overlap Between Natural Gas and Renewable Energy Component Suppliers

- Figure 1: Ohio Clean Energy Manufacturing Map

Clean Energy Regulatory Forum IV

ACSF has established a biannual workshop for industry professionals and environmental advocates to develop new regulatory options for promoting a cleaner, low carbon electricity sector. The 4th workshop in this series was held on November 8-9, 2012, near the headquarters of the PJM Interconnection in Valley Forge, Pennsylvania.

Presentations

M. Gary Helm, PJM Interconnection, Coal Plant Retirements: Potential Impacts of Reduced Energy Demand, Low Natural Gas Prices and the Mercury & Air Toxics Standards Rule

Susan Covino, PJM Interconnection, Resource Adequacy Planning

Paul McGlynn, PJM Interconnection, PJM’s Compliance With FERC Order 1000

Allison Clements, The Sustainable FERC Project, Natural Resources Defense Council, FERC Priorities

Michael Goggin, American Wind Energy Association, Wind Integration and FERC

Ken Schuyler, PJM Interconnection, Paying for System Flexibility: Status of New Ancillary Services

Shucheng Liu, California ISO, System Flexibility for Integrating 33% Renewable Generation in California ISO

Nivad Navid, Midwest ISO, Managing Flexibility in MISO Markets

James T. Gallagher, New York ISO, Integrating Renewable and Variable Energy Resources in the New York Electricity Market

Jonathan Lowell, ISO New England, Paying for System Flexibility

Paul McGlynn, PJM Interconnection, Incorporating State Energy Policy Goals into Regional Electricity Market

Synopsis of Workshop Agenda

November 8, 2012:

1:00 – 2:00pm – Tour of PJM Facilities

2:15 – 5:00pm – Presentations from PJM Staff

- Coal Retirements – Gary Helm

- Resource Adequacy Planning – Susan Covino

- FERC Order 1000 – Paul McGlynn

6:00pm – Welcome Reception and Dinner

November 9, 2012:

8:30am – Welcome and Opening Remarks – Greg Staple, American Clean Skies Foundation

8:45am – Review of FERC Variable Energy Resources (VER) Rules and Update on FERC Proceedings. Panelists include:

- Glen Boshart, Industry Editor/Analyst, SNL Energy (moderator)

- Allison Clements, Director, The Sustainable FERC Project, NRDC

- Michael Goggin, Manager of Transmission Policy, American Wind Energy Association

10:15am – Networking break

10:30am – Paying for System Flexibility: Status of New Ancillary Services to Accommodate Intermittent Resources. Panelists include:

- Rich Sedano, Principal and Director of US Programs, Regulatory Assistance Project (moderator)

- Ken Schuyler, Manager, Renewable Services, PJM

- Shucheng Liu, Principal, Market Development, CAISO

- Nivad Navid, Market Development and Analysis, MISO

- James Gallagher, Senior Manager for Strategic and Business Planning, NYISO

- Jonathan Lowell, Principal Analyst, ISO-NE

12:30pm – Lunch

1:15pm – Incorporating State Energy Policy Goals Into Regional Electricity Markets. Panelists include:

- Greg Staple, CEO, American Clean Skies Foundation (moderator)

- Paul McGlynn, Director, System Planning, PJM

- Malcolm Woolf, Vice President, Government and Regulatory Affairs, Advanced Energy Economy (AEE), and former Director, Maryland Energy Administration

- Robert Powelson, Chairman, Pennsylvania Public Utility Commission

3:30pm – Networking break

3:45pm – Group discussion about potential federal, state, and ISO mechanisms and policies for improving system flexibility.

5:00pm – Adjourn

Tech Effect: How Innovation in Oil and Gas Exploration is Spurring the U.S. Economy

By E. Harry Vidas, Vice President, ICF International.

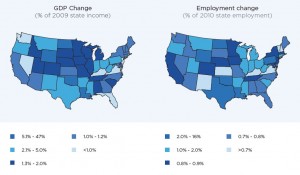

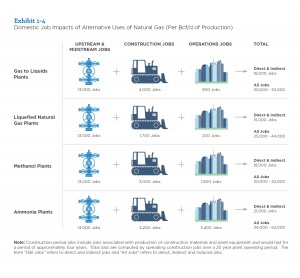

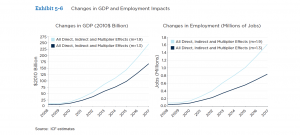

This new ACSF report shows that shale gas and tight oil production will add $167 billion to $245 billion to the U.S. gross domestic product by 2017, and that will deliver 835,000 to 1.6 million new jobs. This is only one of the many ways technological innovations in natural gas and tight oil production are transforming the U.S. economy.

Download Full Report (PDF) | Read Executive Summary | Request Print Copy

Full Report

- Exhibit 1-1 U.S. Map of GDP and Employment Impacts

- Exhibit 1-4 Domestic Job Impacts of Alternative Uses of Natural Gas

- Exhibit 2-2: Map of Lower US Shale Plays

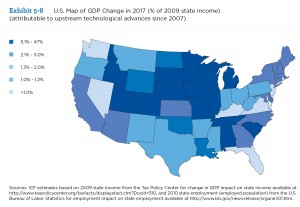

- Exhibit 5-8 U.S. Map of GDP Change in 2017

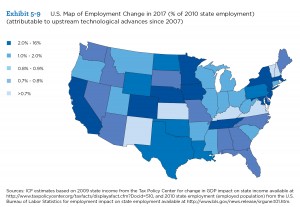

- Exhibit 5-9 U.S. Map of Employment Change in 2017

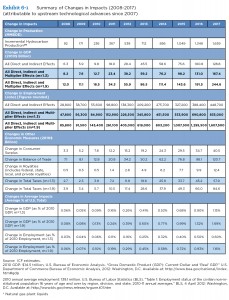

- Exhibit 6-1: Summary of Change in Impacts

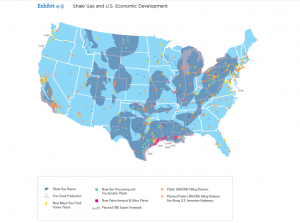

- Exhibit 4-3 Shale Gas and U.S. Economic Development

- Exhibit 5-6 Changes in GDP and Employment Impacts

Power Switch: A No Regrets Guide to Expanding Natural Gas-Fired Electricity Generation

Download the full report here (PDF) | Order a Print Copy

Executive Summary

This report describes a practical “no regrets” plan for U.S. power companies and regulators to take advantage of the lowest natural gas prices in a decade to provide electric ratepayers with cleaner and more affordable power for years to come.

The plan has two main components:

- A new set of long-term gas purchase agreements (and associated hedging arrangements) that share some of the risk of future price changes between natural gas suppliers, on the one hand, and power generators and consumers, on the other. These new agreements would be designed to provide mutually beneficial incentives for gas suppliers and power generators to do business. For example, suppliers and generators could agree to a fixed price for a portion of the fuel, with the balance priced at the market rate.

- A level, non-discriminatory playing field for regulatory review and approval of “prudent” long-term natural gas supply agreements. This would allow regulators to judge options for gas-fired power generation on a fair and level basis vis-à-vis other power sources that routinely make use of long-term supply agreements (e.g., coal, renewables).

This report finds that the economic benefits of locking in record-low prices for natural gas may total tens of billions of dollars. These potential savings are akin to the very large benefits that homeowners and businesses can realize by refinancing mortgages and long-term debt at today’s historically low interest rates.

In 2009, natural gas-fired power plants accounted for 23 percent of national electricity production. A subsequent sharp decline in the price of natural gas —largely triggered by the unprecedented growth of shale gas production— has since led to a substantial increase in gas-fired power generation such that gas is expected to account for approximately 31 percent of the market in 2012.[1] Modern natural gas plants, especially combined cycle gas turbine (CCGT) facilities, are now cheaper to run than many coal-fired power plants. This has delivered savings for ratepayers as well as significant environmental benefits because gas-fired plants also emit less harmful air pollution. However, this report suggests that current benefits may be short lived. Unless key changes to commercial and regulatory frameworks are established at the state level, longer-term, large- scale fuel shifts by existing power plants and commitments to new gas-fired capacity are at risk.

Shale gas development has prompted some controversy, particularly in regards to potential environmental impacts. Environmental risks and associated price impacts, however, are manageable with existing technologies and best practices. Responsible development of natural gas resources is necessary to sustain a successful, no-regrets transition to affordable gas in the electric sector.

The new plan outlined in this report will require at least five major groups of stakeholders to be involved:

- Natural gas suppliers, including major producers and marketing groups, must be willing to offer viable, multi-year pricing agreements for a portion of their inventory; they must also be willing to share some of the risk of future price changes.

- Utilities and merchant generators must be willing to consider prudent, multi-year pricing agreements for a portion of their fuel needs; and they must be willing to share some of the risk of future price changes.

- Regulators and state governments must adopt a regulatory framework for the approval of prudent, long-term fuel-supply agreements that does not discriminate against natural gas. In addition, regulators must be willing to closely scrutinize any new short-term natural gas supply agreements and should reconsider the automatic pass-through of spot market fuel costs absent a showing that longer-term arrangements are not a more prudent course of action.

- Consumer advocates must be willing to support prudent, long-term natural gas supply arrangements before state regulatory bodies and legislatures where such arrangements, notwithstanding some price risks, can be expected to deliver significant long-term rate benefits.

- Natural gas pipelines and pipeline regulators must be willing to work with power plant operators to agree on appropriate transport tariffs for natural gas purchased under new, multi-year pricing arrangements.

We do not recommend that generators rely solely on long-term agreements for their gas requirements, nor should gas suppliers sell gas solely in these fashions. Instead, we believe generators and natural gas producers should supplement their current strategies with long- term agreements as a way to reduce costs and risks while increasing resource diversity and supply certainty.

This report presents the economic case for fuel switching based on three analyses: a “busbar” analysis of the comparative construction and operating costs of gas-fired plants vis-à-vis competitors; illustrative power plant retirement reviews based on different fuel costs; and a “minimax regret” analysis that evaluates risks associated with fuel procurement strategies, such as the innovative risk-sharing arrangements recommended in this report. Details of each analysis are provided in the appendices.

Clean Energy Regulatory Forum III

ACSF has established a biannual workshop for industry professionals and environmental advocates to develop new regulatory options for promoting a cleaner, low carbon electricity sector. The 3rd workshop in this series, held on April 19-20, 2012, was co-hosted at the National Renewable Energy Laboratory in Golden, Colorado with the Joint Institute for Strategic Energy Analysis.

Presentations

Paul Denholm, National Renewable Energy Laboratory, How PV and CSP with Thermal Storage Can Work Together

Craig Turchi, National Renewable Energy Laboratory, CSP and Natural Gas Hybrids

Easan Drury, National Renewable Energy Laboratory, U.S. PV Market Landscape

Russell Young, GE Energy, Concentrated Solar Power

Cara Libby, Electric Power Research Institute, Utility Perspective: Solar Thermal Hybrid Projects

Greg Brinkman, National Renewable Energy Laboratory, Impacts of Renewable Generation on Fossil Fuel Unit Cycling: Costs and Emissions

Paul Hibbard, Analysis Group, Variable Resources in Capacity Markets, Market Rule Adjustments and Balancing Resource Options

Christopher Carr, C2E2 Strategies, EPA Power Plant Regulations and Clean Energy: A New Paradigm?

Ron Binz, Public Policy Consulting, Progress Under the Clean Air Clean Jobs Act

Austin Whitman, M.J. Bradley & Associates, Energy Sector Modeling and Fuel Price Assumptions

Patrick Bean, American Clean Skies Foundation, Locking In the Benefits to Fuel Switching

David Hart, Center for Science and Technology Policy at George Mason University, Unlocking Energy Innovation

Synopsis of Workshop Agenda

April 19th: Updates, new analysis and background presentations

8:00 – 8:30am – Workshop introduction – Greg Staple, Chief Executive Officer, American Clean Skies Foundation; and Doug Arent, Executive Director, Joint Institute for Strategic Energy Analysis

8:30 – 12:15pm – Moving Towards a Cleaner Power Paradigm

- Utility Scale Solar and Gas: Options for Thermal Solar and PV(120 minutes)

- Solar, Storage, and Natural Gas Hybrids: Paul Denholm, Craig Turchi, and Easan Drury, NREL

- Facilitated Discussion on Developer and Utility Perspectives: Udi Helman (BrightSource), Russell Young (GE Energy), Cara Libby (EPRI), and Mark Marion (juwi solar, Inc.)

- Impacts of Renewable Generation on Fossil Fuel Unit Cycling: Costs and Emissions (Greg Brinkman, NREL) (45 minutes)

- Variable Resources in Capacity Markets, Market Rule Adjustments and Balancing Resource Options (Paul Hibbard, Analysis Group) (45 minutes)

12:15 – 1:45pm – Lunch

- Survey of Ongoing Projects: Update from NREL/JISEA

- Renewable Energy Futures Study, Trieu Mai

- The Energy Systems Integration Facility (ESIF), Ben Kroposki

- Energy Data Visualization, Dan Getman

2:00 – 3:00pm – Coal Retirements and Action at the State Level

- EPA’s Clean Air Regulations: State of Litigation on CSAPR and MATS (Chris Carr, C2E2 Strategies)

- Implementing Colorado’s Clean Air-Clean Jobs Act: Reviewing Two Years of Progress (Ron Binz, former CO PUC Commissioner and Frank Prager, Xcel Energy)

3:15 – 5:00pm – Coal Retirements and Action at the State Level (cont.)

- Overview of Fuel Price Trajectories for Natural Gas and Coal

- Energy Sector Modeling and Fuel Price Assumptions (Austin Whitman, M.J. Bradley & Associates)

- ACSF Report: Locking in the Benefits of Fuel Switching (Patrick Bean, ACSF)

- Oklahoma’s New Competitive Procurement Process for Electric Utilities to Secure Long-Term Fuel Supply (Jim Roth, Phillips Murrah P.C.)

6:30 – 9:00pm – Reception and Dinner

Keynote – David Hart, co-author of ‘Unlocking Energy Innovation’

April 20th: Where do we go from here? Refining our Priorities and Next Steps

8:30 – 9:45am – Morning Panel – Clean Energy Policy Landscape in the West, Led by Gov. Bill Ritter, Center for the New Energy Economy, Colorado State University with Kate Fay, Energy Advisor, EPA Region 8; Maryanne Kurtinaitis, Colorado Renewable Energy Lead, Bureau of Land Management; Matt Baker, Commissioner, Colorado Public Utility Commission, and Bob Randall, Deputy Director, Colorado Department of Natural Resources.

10:00 – 12:00 – Synthesis and Next Steps

From a Bridge to a Destination: Gas Fired Power After 2020

On March 12, ACSF issued a new, 227-page publication which brings together more than a dozen presentations made at the Foundation’s landmark November 4, 2011, public forum on Carbon Capture and Sequestration (CCS) for natural gas-fired electricity generation. CCS for gas-fired plants may be needed over the long term if there is widespread future regulation of greenhouse gas emissions. The ACSF forum brought together leaders from the Clean Energy Group of utilities, Great Plains Institute, President’s Interagency Task Force on CCS, California CCS Review Panel, MIT, Carnegie Mellon University, the Clean Air Task Force, EPA and other organizations to review the presentations. Hard copies are available on request; the report can also be downloaded here – (PDF, 36.5 MB).

Pre-conference documents, media and schedule are still available below.

A CARBON CAPTURE AND STORAGE LEADERSHIP FORUM FOR NATURAL GAS POWER PLANTS

While combined cycle gas turbine facilities emit roughly 60% less CO2 per kilowatt hour than conventional coal generators, over the long term controlling the CO2 footprint of gas-fired power via carbon capture and storage (CCS) will be essential for achieving our carbon reduction goals.

Today, however, U.S. RD&D efforts have concentrated almost exclusively on developing and deploying CCS for coal.

Click here to download our CCS Forum Flyer.

Click here to see ACSF’s background paper.

Agenda

- 8:30 am – 9:00 am

- Registration and Continental Breakfast

- 9:00 am – 9:15 am

- Introduction, Forum Overview: Greg Staple, CEO, American Clean Skies Foundation

- 9:15 am – 10:15 am

- Natural Gas and CCS: Framing the Issues (Video )

- Jerome Hinkle, VP Policy and Research, American Clean Skies Foundation; Download PDF

- Joel Swisher, CAMCO International; Consulting Professor of Civil and Environmental Engineering, Stanford University; (Presented by Jerome Hinkle) Download PDF

- Carl Bauer, Chair, California Carbon Capture and Storage Review Panel; former Director, National Energy Technology Laboratory; Download PDF

- 10:15 am – 10:30 am

- Break

- 10:30 am – 12:00 pm

- CS Technology and Economics for Natural Gas(Video )

- Robert Hilton, Alstom Power; Download PDF

- Howard Herzog, Senior Research Engineer, MIT Energy Initiative; Download PDF

- Edward Rubin, The Alumni Professor of Environmental Engineering and Science; Professor, Engineering and Public Policy and Mechanical Engineering, Carnegie Mellon University; Download PDF

- 12:10 pm – 1:00 pm

- Lunch

Keynote: Politics of RD&D Funding: Honorable Byron L. Dorgan, retired; Senator from North Dakota—Chairman, Energy and Water Appropriations Subcommittee; Chairman, Democratic Policy Committee, senior member, Energy and Natural Resources Committee; Chairman, Indian Affairs Committee; now Senior Fellow at the Bipartisan Policy Center, and Co-chair of the BPC Energy Project.

(Video ) - 1:00 pm – 2:30 pm

- Demonstrating CCS(Video )

- Brad Crabtree, Policy Director, Great Plains Institute; Download PDF

- Michael Holmes, PCOR Director, Energy and Environmental Research Center, University of North Dakota; Download PDF

- Mark Taylor, Lead Analyst, CCS & Geothermal, Bloomberg New Energy Finance

- George Peridas, Scientist, Climate Center, Natural Resources Defense Council; Download PDF

- 2:30 pm – 2:45 pm

- Break

- 2:45 pm – 4:15 pm

- Deploying CCS on Natural Gas: Policy and Regulatory Landscape(Video )

- Tom Curry, Vice President, M.J. Bradley & Associates LLC; Download PDF

- Dina Kruger, Principal, Kruger Environmental Strategies, former Director of the Climate Change Division, USEPA; President’s CCS Task Force; Download PDF

- Don Neal, Vice President Environment, Health, and Safety, Calpine Corporation; Download PDF

- 4:15 pm – 4:30 pm

- Closing Thoughts: Jerome Hinkle, VP Policy and Research, American Clean Skies Foundation

The Climate Impact Of Natural Gas and Coal-Fired Electricity: A Review of Fuel Chain Emissions Based on Updated EPA National Inventory Data

Full Report (PDF) | Full report (HTML, one page) | In the Press

This paper provides an updated, comparative fuel chain calculation of the greenhouse gas (GHG) emissions of natural gas- and coal-fired electricity. The analysis incorporates revised 2011 US EPA estimates of fugitive methane emissions from the upstream (i.e., production) portion of the fuel chain. Based on this revised EPA data and average generation heat rates, we find that existing gas-fired generation is still, on average, about 51% less GHG intensive than existing coal-fired generation. Similarly, a new gas-fired combined-cycle unit produces about 52% less GHG emissions per kWh than a new coal-fired steam unit; about 58% less than the average coal-fired unit; and about 63% less than a typical older coal-fired unit.

Key relevant concepts include:

- footprint/fuel chain

- fugitive emission

- efficiency

- GHG intensity

Read the report (Adobe PDF document).

In The Press

Cornell study on shale gas flawed?: UPI.com, April 20 2011.

Emissions All In, Gas Still Beats Coal, Says Report: NGI’s Shale Daily, April 22 2011.