LNG Emerging As Fuel Of Choice For Vessels, Ferries

Report Finds More Natural Gas Vehicles Would Not Raise Natural Gas Prices

Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Our new report finds that a transition to natural gas-fueled heavy duty and light duty vehicles over the next decade will have a minimal impact on natural gas prices. The report uses three scenarios to calculate potential natural gas demand and price impacts attributable to natural gas vehicles (NGVs).

Full Report

Download PDF • Request Print Copy

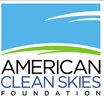

- Figure 5: Price Components of Retail CNG

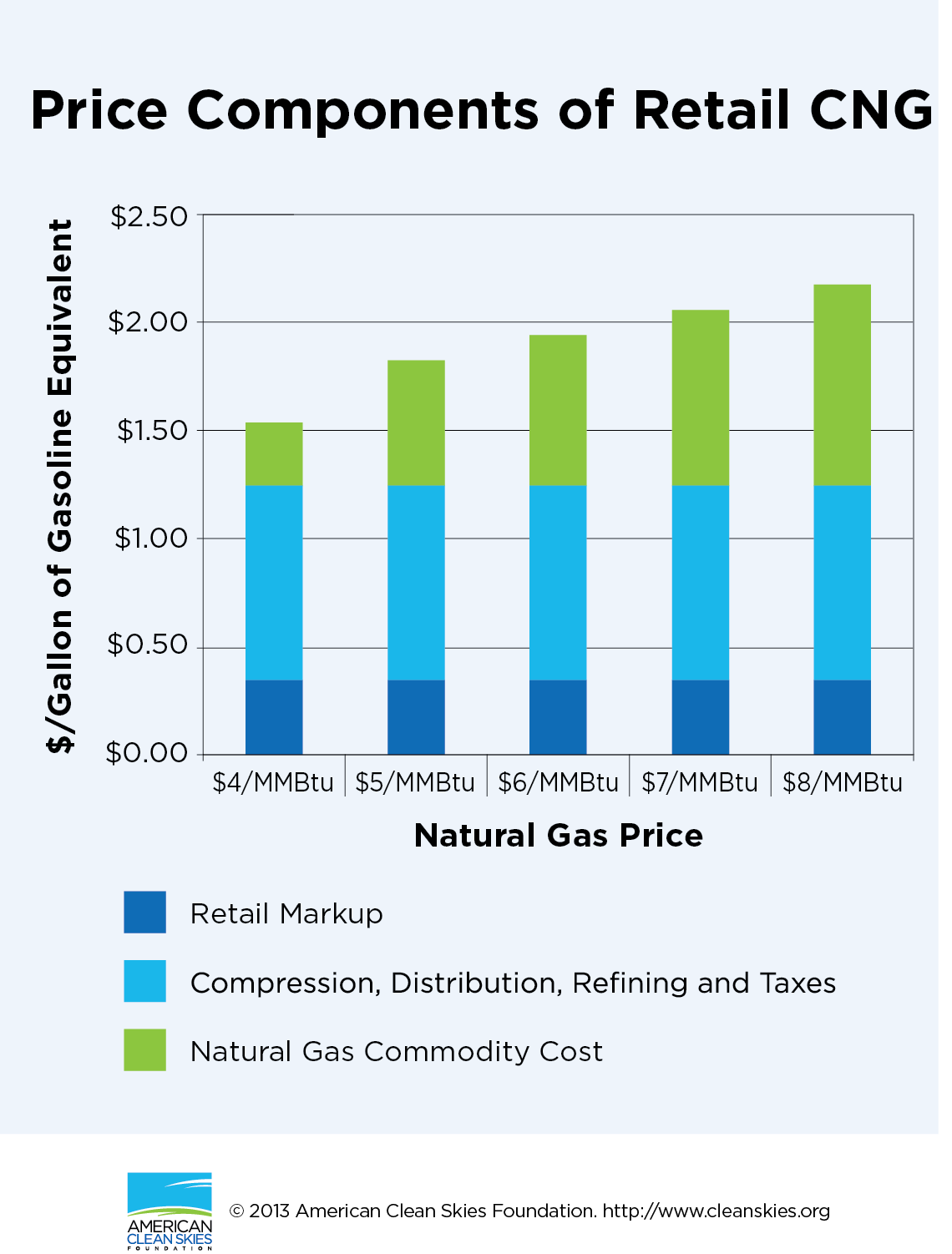

- Figure 1: Natural Gas Demand, Transportation vs. Power Generation

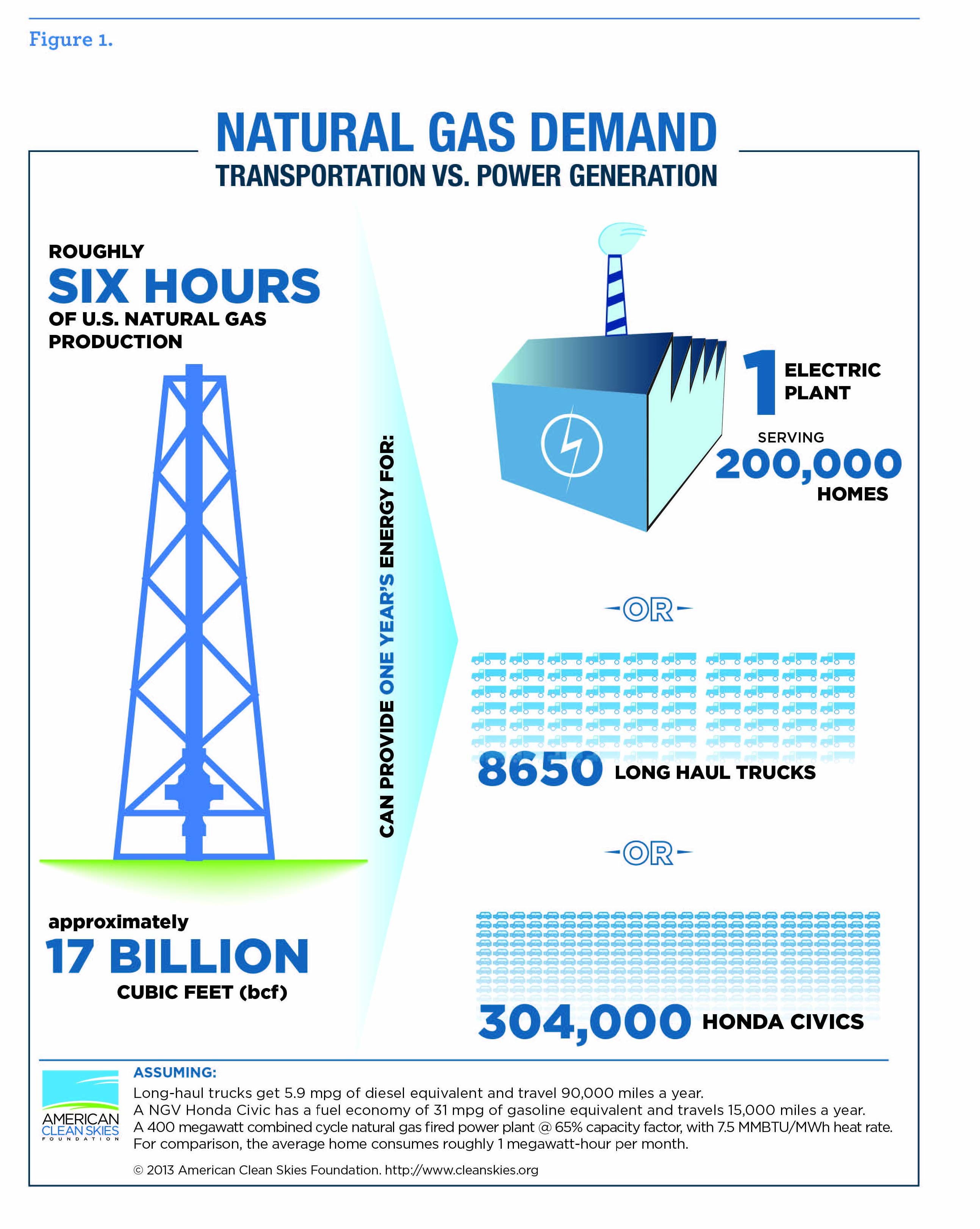

- Figure 9: One Well=14,000 Honda Civics Driving with Natural Gas

Post-Election Prospects for Natural-Gas-Fired Generation

ACSF, Moniz Team Up for “Future of Natural Gas”

The Future of Natural Gas: An Interdisciplinary MIT Study

ACSF and several other groups initiated and sponsored the report. The other groups included the MIT Energy Initiative (MITEI) members Hess Corporation and Agencia Naçional de Hidrocarburos (Colombia), the Gas Technology Institute (GTI), Exelon, and an anonymous donor. Gregory C. Staple, the Foundation’s CEO, served on the report’s 18-person advisory committee. Incoming Energy Secretary Ernest J. Moniz, former MITEI director, testified before the U.S. Senate Committee on Energy and Natural Resources about this report.

Full Report

Download PDF • Request Print Copy

In the Press

Ernest Moniz, MIT Physicist, Nominated as Energy Secretary: The Washington Post, March 4, 2013

An M.I.T. Plan for Natural Gas with Planet in Mind: New York Times, June 9, 2011

MIT: Natural Gas to Become More Entwined in US Economy: SNL Financial, June 9, 2011

Natural Gas Gives Edge to US Manufacturers: Financial Times, June 8, 2011

The Future of Natural Gas: Geology.com, June 28, 2010

Does Our Energy Future Line in Natural Gas?: Consumer Affairs, June 28, 2010

The Future of Natural Gas: RedOrbit, June 28, 2010

Offshore Drilling Uncertainty Likely to Boost Search for Onshore Deposits: allvoices, June 28, 2010

Study Says Natural Gas Use Likely to Double: New York Times, June 25, 2010

MIT Study Urges US Gas Industry to Back Price on Carbon Emissions: Platts, June 25, 2010

For Climate Relief, US Will Turn to Gas: Nature.com, June 25, 2010

MIT Researchers See Natural Gas as the Choice for Lower Carbon Emissions: New York Times, June 25, 2010

MIT: The Future Is A (Natural) Gas: Forbes, June 25, 2010

Natural Gas Seen as Key in a Carbon-Constrained Futuree: Greentech Media, June 25, 2010

MIT Releases Major Report: The Future of Natural Gas: PhysOrg.com, June 25, 2010

MITEI-Led Study Offers Comprehensive Look at The Future of Natural Gas: MIT News, June 25, 2010

Natural Gas Use to Double in US in Coming Decades: MIT Report: Treehugger, June 25, 2010

European Views On American Natural Gas Exports

This strategic primer highlights the joint economic and security interests the United States and Europe have regarding the export of liquefied natural gas (LNG). It details the major transatlantic connections underlying the export debate.

Full Report

Download PDF • Request Print Copy

- Figure 6: Historical Natural Gas Prices

European Views on American Natural Gas Exports

Where Can I Fill Up? 2013 Update

Where Can I Fill Up? 2013 Assessment

This updated edition of Where Can I Fill Up? expands on the information in the August 2012 report. It provides more than 20 pages of new information on who is building NGV fueling infrastructure, along with more detail on where and how this infrastructure is being added and government policies pertaining to the development of NGV fueling infrastructure.

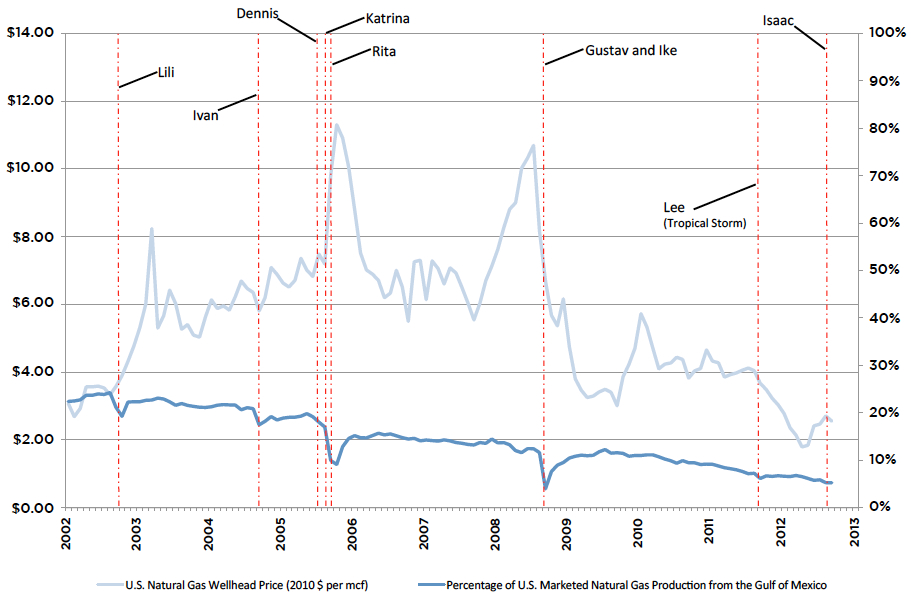

Shale Revolution Moves Natural Gas Production Onshore Reducing Hurricane Price Shocks

The chart above shows that the rise in U.S. onshore natural gas production has tended to diminish the impact of hurricanes on prices. The percentage of onshore production is shown on the right axis and gas prices on the left axis. The most recent hurricane, Isaac, struck the Louisiana coast on August 28th as a Category 1 storm. Isaac knocked out electricity to more than 900,000 homes and is estimated to have caused about $2 billion in damage in Louisiana alone. However, unlike previous hurricanes, it had a negligible impact on natural gas prices nationwide. In the first half of 2012 before Isaac hit, U.S. marketed gas production averaged 6.2 percent from Federal Gulf of Mexico waters. Seven years before, the percentage averaged 19.2 percent.

Two years ago the American Clean Skies Foundation and the Bipartisan Policy Center jointly convened the Task Force on Ensuring Stable Natural Gas Markets to examine historic causes of instability in natural gas markets and to explore potential remedies. One of the Task Force’s findings was that the growth of on-shore shale gas was reducing the susceptibility of gas markets to price instability (while also accommodating new demand). The relatively minimal impact of recent Gulf hurricanes on gas prices provides support for this thesis. To learn more, read the report of the 2010 Task Force on Ensuring Stable Natural Gas Markets.

Sources

Natural gas price and production data: Energy Information Administration, November 30, 2012, http://www.eia.gov/naturalgas/data.cfm

Also see:

- Hurricane Damage to Natural Gas Infrastructure and Its Effect on the U.S. Natural Gas Market. Energy and Environmental Analysis, Inc. November 2005.

- Comparing the Impacts of the 2005 and 2008 Hurricanes on U.S. Energy Infrastructure. U.S. Department of Energy. February 2009.

- Short-Term Energy Outlook Supplement: 2012 Outlook for Hurricane-Related Production Outages in the Gulf of Mexico. U.S. Energy Information Administration. June 2012.

- BSEE Hurricane Isaac Activity Statistics: August 29, 2012. Bureau of Safety and Environmental Enforcement.

Politico 2012: Shale Gas Rocks the Economy…And Politics

Where Can I Fill Up?

This new 60 page ACSF report provides a comprehensive up-to-date survey of private sector and state government initiatives to build out natural gas vehicle (NGV) fueling stations across America. It covers investments in new CNG and LNG facilities and contains detailed state-by-state profiles of incentives (tax credits, loans, grants, public utility programs) now available to promote NGV infrastructure.

A New Energy Option: North America’s New Natural Gas Resources And Their Potential Impact On Energy and Climate Security

By Gregory C. Staple Esq. and Joel L. Swerdlow, Ph.D., 2009.

Working Paper

Politico 2012: Shale Gas Rocks The Economy…And Politics

During the recent Republican and Democratic presidential nominating conventions, ACSF distributed more than 60,000 copies of a special eight-page newspaper supplement about America’s shale gas story and the Foundation’s policy work. This unique advertising supplement was prepared by ACSF in conjunction with the Washington D.C.-based Politico newspaper and was inserted in the local Tampa Bay Times and Charlotte Observer newspapers provided to all convention participants. More than 30,000 copies of the supplement were also distributed in Washington D.C. as part of a post-convention issue of Politico.

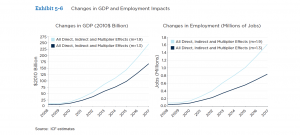

Tech Effect: How Innovation in Oil and Gas Exploration is Spurring the U.S. Economy

By E. Harry Vidas, Vice President, ICF International.

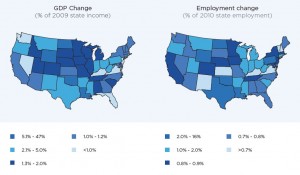

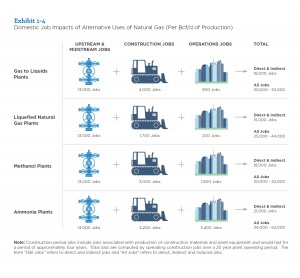

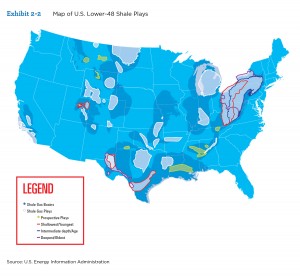

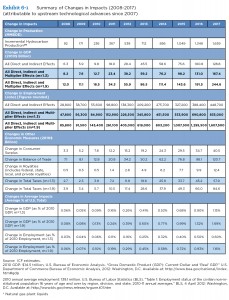

This new ACSF report shows that shale gas and tight oil production will add $167 billion to $245 billion to the U.S. gross domestic product by 2017, and that will deliver 835,000 to 1.6 million new jobs. This is only one of the many ways technological innovations in natural gas and tight oil production are transforming the U.S. economy.

Download Full Report (PDF) | Read Executive Summary | Request Print Copy

Full Report

- Exhibit 1-1 U.S. Map of GDP and Employment Impacts

- Exhibit 1-4 Domestic Job Impacts of Alternative Uses of Natural Gas

- Exhibit 2-2: Map of Lower US Shale Plays

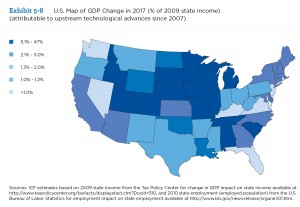

- Exhibit 5-8 U.S. Map of GDP Change in 2017

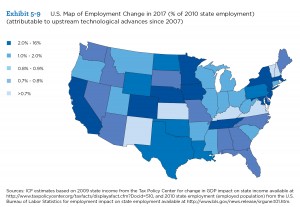

- Exhibit 5-9 U.S. Map of Employment Change in 2017

- Exhibit 6-1: Summary of Change in Impacts

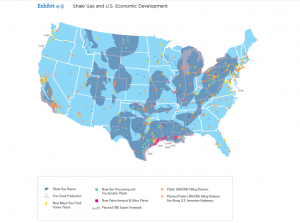

- Exhibit 4-3 Shale Gas and U.S. Economic Development

- Exhibit 5-6 Changes in GDP and Employment Impacts

Shale Gas Powers the Country

This map was originally published in Politico’s presidential nominating convention newspapers.

Data Sources

- Shale Gas Basins: Energy Information Administration, May 9, 2011, http://www.eia.gov/oil_gas/rpd/shale_gas.pdf

- Frac Sand Production: ICF International.

- New Major Gas-Fired Power Plants: SNL Financial, accessed June 12, 2012.

- Included are all planned natural gas-fired power plants with construction costs estimated to exceed $100,000,000.

- New Gas Processing and Fractionation Plants: Oil and Gas Journal, May 7, 2012.

- New Petrochemical and Other Plants: ICF International

- Existing and Planned Public LNG/CNG Filing Stations: Department of Energy, Alternative Fuels and Advanced Vehicles Data Center, accessed June 1, 2012, http://www.afdc.energy.gov/afdc/fuels/stations.html

- Included are all existing and planned public CNG and LNG fueling stations (no private/fleet only fueling stations).

- Planned LNG Export Terminals: Federal Energy Regulatory Commission, July 17, 2012, http://ferc.gov/industries/gas/indus-act/lng/LNG-proposed-potential.pdf and http://www.ferc.gov/industries/gas/indus-act/lng/LNG-approved.pdf

- Included are all export terminals that are either approved and under construction or proposed to the FERC.

Where Can I Fill Up?

Oil Shift: The Case for Switching Federal Transportation Spending to Alternative Fuel Vehicles

Power Switch: A No Regrets Guide to Expanding Natural Gas-Fired Electricity Generation

Power Switch: A No Regrets Guide to Expanding Natural Gas-Fired Electricity Generation

Download the full report here (PDF) | Order a Print Copy

Executive Summary

This report describes a practical “no regrets” plan for U.S. power companies and regulators to take advantage of the lowest natural gas prices in a decade to provide electric ratepayers with cleaner and more affordable power for years to come.

The plan has two main components:

- A new set of long-term gas purchase agreements (and associated hedging arrangements) that share some of the risk of future price changes between natural gas suppliers, on the one hand, and power generators and consumers, on the other. These new agreements would be designed to provide mutually beneficial incentives for gas suppliers and power generators to do business. For example, suppliers and generators could agree to a fixed price for a portion of the fuel, with the balance priced at the market rate.

- A level, non-discriminatory playing field for regulatory review and approval of “prudent” long-term natural gas supply agreements. This would allow regulators to judge options for gas-fired power generation on a fair and level basis vis-à-vis other power sources that routinely make use of long-term supply agreements (e.g., coal, renewables).

This report finds that the economic benefits of locking in record-low prices for natural gas may total tens of billions of dollars. These potential savings are akin to the very large benefits that homeowners and businesses can realize by refinancing mortgages and long-term debt at today’s historically low interest rates.

In 2009, natural gas-fired power plants accounted for 23 percent of national electricity production. A subsequent sharp decline in the price of natural gas —largely triggered by the unprecedented growth of shale gas production— has since led to a substantial increase in gas-fired power generation such that gas is expected to account for approximately 31 percent of the market in 2012.[1] Modern natural gas plants, especially combined cycle gas turbine (CCGT) facilities, are now cheaper to run than many coal-fired power plants. This has delivered savings for ratepayers as well as significant environmental benefits because gas-fired plants also emit less harmful air pollution. However, this report suggests that current benefits may be short lived. Unless key changes to commercial and regulatory frameworks are established at the state level, longer-term, large- scale fuel shifts by existing power plants and commitments to new gas-fired capacity are at risk.

Shale gas development has prompted some controversy, particularly in regards to potential environmental impacts. Environmental risks and associated price impacts, however, are manageable with existing technologies and best practices. Responsible development of natural gas resources is necessary to sustain a successful, no-regrets transition to affordable gas in the electric sector.

The new plan outlined in this report will require at least five major groups of stakeholders to be involved:

- Natural gas suppliers, including major producers and marketing groups, must be willing to offer viable, multi-year pricing agreements for a portion of their inventory; they must also be willing to share some of the risk of future price changes.

- Utilities and merchant generators must be willing to consider prudent, multi-year pricing agreements for a portion of their fuel needs; and they must be willing to share some of the risk of future price changes.

- Regulators and state governments must adopt a regulatory framework for the approval of prudent, long-term fuel-supply agreements that does not discriminate against natural gas. In addition, regulators must be willing to closely scrutinize any new short-term natural gas supply agreements and should reconsider the automatic pass-through of spot market fuel costs absent a showing that longer-term arrangements are not a more prudent course of action.

- Consumer advocates must be willing to support prudent, long-term natural gas supply arrangements before state regulatory bodies and legislatures where such arrangements, notwithstanding some price risks, can be expected to deliver significant long-term rate benefits.

- Natural gas pipelines and pipeline regulators must be willing to work with power plant operators to agree on appropriate transport tariffs for natural gas purchased under new, multi-year pricing arrangements.

We do not recommend that generators rely solely on long-term agreements for their gas requirements, nor should gas suppliers sell gas solely in these fashions. Instead, we believe generators and natural gas producers should supplement their current strategies with long- term agreements as a way to reduce costs and risks while increasing resource diversity and supply certainty.

This report presents the economic case for fuel switching based on three analyses: a “busbar” analysis of the comparative construction and operating costs of gas-fired plants vis-à-vis competitors; illustrative power plant retirement reviews based on different fuel costs; and a “minimax regret” analysis that evaluates risks associated with fuel procurement strategies, such as the innovative risk-sharing arrangements recommended in this report. Details of each analysis are provided in the appendices.

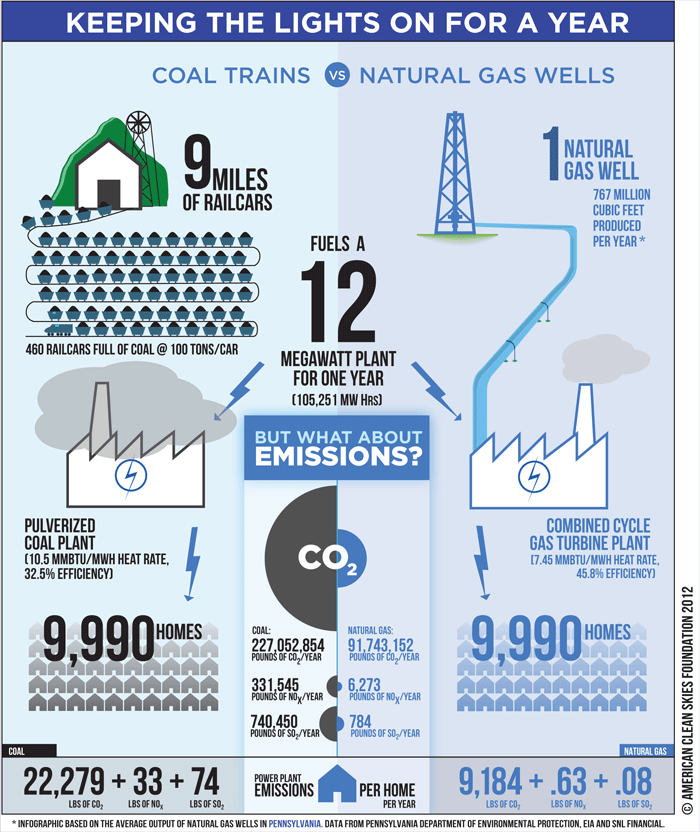

Keeping the Lights on for a Year

[sharethis]

Energy 101: Natural Gas Power Plants

In this episode of Energy 101 host Lacey Lett explains how combined cycle natural gas-fired power plants work.

Energy 101: Natural Gas Transportation

As America produces more and more natural gas, lots of people are thinking about using clean-burning natural gas to run our cars and trucks. It’s not only likely to cost less but it could cut back our oil imports a whole lot, especially from unfriendly regimes.

Natural Gas for Marine Vessels: U.S. Market Opportunities

As diesel fuel costs become higher and more volatile, the transportation sector is buzzing about the potential for natural gas to move our goods and services. Most of the talk has focused on fleet vehicles and heavy-duty trucks. This winter ACSF commissioned a review of the maritime market opportunities for natural gas. The study offers the first in-depth look at the challenges and prospects for converting U.S. marine vessels to liquefied natural gas (LNG).

A PDF of the report is available for download here (36 pages).

From a Bridge to a Destination: Gas-Fired Power After 2020

On March 12, ACSF issued a new, 227-page publication which brings together more than a dozen presentations made at the Foundation’s landmark November 4, 2011, public forum on Carbon Capture and Sequestration (CCS) for natural gas-fired electricity generation. CCS for gas-fired plants may be needed over the long term if there is widespread future regulation of greenhouse gas emissions. The ACSF forum brought together leaders from the Clean Energy Group of utilities, Great Plains Institute, President’s Interagency Task Force on CCS, California CCS Review Panel, MIT, Carnegie Mellon University, the Clean Air Task Force, EPA and other organizations to review the presentations. Hard copies are available on request; the report can also be downloaded here – (PDF, 36.5 MB).

From a Bridge to a Destination: Gas Fired Power After 2020

On March 12, ACSF issued a new, 227-page publication which brings together more than a dozen presentations made at the Foundation’s landmark November 4, 2011, public forum on Carbon Capture and Sequestration (CCS) for natural gas-fired electricity generation. CCS for gas-fired plants may be needed over the long term if there is widespread future regulation of greenhouse gas emissions. The ACSF forum brought together leaders from the Clean Energy Group of utilities, Great Plains Institute, President’s Interagency Task Force on CCS, California CCS Review Panel, MIT, Carnegie Mellon University, the Clean Air Task Force, EPA and other organizations to review the presentations. Hard copies are available on request; the report can also be downloaded here – (PDF, 36.5 MB).

Pre-conference documents, media and schedule are still available below.

A CARBON CAPTURE AND STORAGE LEADERSHIP FORUM FOR NATURAL GAS POWER PLANTS

While combined cycle gas turbine facilities emit roughly 60% less CO2 per kilowatt hour than conventional coal generators, over the long term controlling the CO2 footprint of gas-fired power via carbon capture and storage (CCS) will be essential for achieving our carbon reduction goals.

Today, however, U.S. RD&D efforts have concentrated almost exclusively on developing and deploying CCS for coal.

Click here to download our CCS Forum Flyer.

Click here to see ACSF’s background paper.

Agenda

- 8:30 am – 9:00 am

- Registration and Continental Breakfast

- 9:00 am – 9:15 am

- Introduction, Forum Overview: Greg Staple, CEO, American Clean Skies Foundation

- 9:15 am – 10:15 am

- Natural Gas and CCS: Framing the Issues (Video )

- Jerome Hinkle, VP Policy and Research, American Clean Skies Foundation; Download PDF

- Joel Swisher, CAMCO International; Consulting Professor of Civil and Environmental Engineering, Stanford University; (Presented by Jerome Hinkle) Download PDF

- Carl Bauer, Chair, California Carbon Capture and Storage Review Panel; former Director, National Energy Technology Laboratory; Download PDF

- 10:15 am – 10:30 am

- Break

- 10:30 am – 12:00 pm

- CS Technology and Economics for Natural Gas(Video )

- Robert Hilton, Alstom Power; Download PDF

- Howard Herzog, Senior Research Engineer, MIT Energy Initiative; Download PDF

- Edward Rubin, The Alumni Professor of Environmental Engineering and Science; Professor, Engineering and Public Policy and Mechanical Engineering, Carnegie Mellon University; Download PDF

- 12:10 pm – 1:00 pm

- Lunch

Keynote: Politics of RD&D Funding: Honorable Byron L. Dorgan, retired; Senator from North Dakota—Chairman, Energy and Water Appropriations Subcommittee; Chairman, Democratic Policy Committee, senior member, Energy and Natural Resources Committee; Chairman, Indian Affairs Committee; now Senior Fellow at the Bipartisan Policy Center, and Co-chair of the BPC Energy Project.

(Video ) - 1:00 pm – 2:30 pm

- Demonstrating CCS(Video )

- Brad Crabtree, Policy Director, Great Plains Institute; Download PDF

- Michael Holmes, PCOR Director, Energy and Environmental Research Center, University of North Dakota; Download PDF

- Mark Taylor, Lead Analyst, CCS & Geothermal, Bloomberg New Energy Finance

- George Peridas, Scientist, Climate Center, Natural Resources Defense Council; Download PDF

- 2:30 pm – 2:45 pm

- Break

- 2:45 pm – 4:15 pm

- Deploying CCS on Natural Gas: Policy and Regulatory Landscape(Video )

- Tom Curry, Vice President, M.J. Bradley & Associates LLC; Download PDF

- Dina Kruger, Principal, Kruger Environmental Strategies, former Director of the Climate Change Division, USEPA; President’s CCS Task Force; Download PDF

- Don Neal, Vice President Environment, Health, and Safety, Calpine Corporation; Download PDF

- 4:15 pm – 4:30 pm

- Closing Thoughts: Jerome Hinkle, VP Policy and Research, American Clean Skies Foundation

All About Shale Gas

Shale Gas and America’s Future is a 30-minute, made-for-TV film that looks at how local communities in Pennsylvania are dealing with the potential benefits and risks of shale gas development. In November 2012 the film was awarded the top prize for short documentaries by the Washington D.C.-area association of the Television, Internet & Video Association (TIVA). The film was produced for ACSF in 2010 by the award-winning, Washington D.C.-based documentary group Hillmann & Carr. Click on the image below to view the film.

The second image takes you to ShaleCountry.com. This web site features first-person accounts of the impact of gas production on the economy, the environment and the lives of people living in major shale “plays”– the Haynesville in Louisiana, the Fayetteville in Arkansas, and the Marcellus in New York and Pennsylvania.

[SlideDeck id=’809′ width=’682px’ height=’280px’]

Today experts tell us that America has roughly a 100-year supply of natural gas, a fuel that burns with 50% less global warming pollution than coal, and 20% less than most petroleum fuels. And, on a barrels-to-barrels comparison, in 2010, domestic U.S. production of natural gas was greater than that of coal and almost double that for oil.

The Climate Impact Of Natural Gas and Coal-Fired Electricity: A Review of Fuel Chain Emissions Based on Updated EPA National Inventory Data

Full Report (PDF) | Full report (HTML, one page) | In the Press

This paper provides an updated, comparative fuel chain calculation of the greenhouse gas (GHG) emissions of natural gas- and coal-fired electricity. The analysis incorporates revised 2011 US EPA estimates of fugitive methane emissions from the upstream (i.e., production) portion of the fuel chain. Based on this revised EPA data and average generation heat rates, we find that existing gas-fired generation is still, on average, about 51% less GHG intensive than existing coal-fired generation. Similarly, a new gas-fired combined-cycle unit produces about 52% less GHG emissions per kWh than a new coal-fired steam unit; about 58% less than the average coal-fired unit; and about 63% less than a typical older coal-fired unit.

Key relevant concepts include:

- footprint/fuel chain

- fugitive emission

- efficiency

- GHG intensity

Read the report (Adobe PDF document).

In The Press

Cornell study on shale gas flawed?: UPI.com, April 20 2011.

Emissions All In, Gas Still Beats Coal, Says Report: NGI’s Shale Daily, April 22 2011.

National Producer-Consumer Task Force Sees Promise In More Stable Natural Gas Prices

Findings & Recommendations | Full Report (PDF) | Task Force Members | Original Commissioned Research | In the Press

On March 22, the American Clean Skies Foundation and the Bipartisan Policy Center released the final report of a jointly convened task force of environmentalists, consumer advocates and natural gas users that looked at natural gas markets.

Read the complete 70-page report (Adobe PDF document, ~5MB).

Key Task Force Findings and Recommendations

- Recent developments allowing for the economic extraction of natural gas from shale formations reduce the susceptibility of gas markets to price instability and provide an opportunity to expand the efficient use of natural gas in the United States.

- Government policy at the federal, state and municipal level should encourage and facilitate the development of domestic natural gas resources, subject to appropriate environmental safeguards. Balanced fiscal and regulatory policies will enable an increased supply of natural gas to be brought to market at more stable prices. Conversely, policies that discourage the development of domestic natural gas resources, that discourage demand, or that drive or mandate inelastic demand will disrupt the supply-demand balance, with adverse effects on the stability of natural gas prices and investment decisions by energy-intensive manufacturers.

- The efficient use of natural gas has the potential to reduce harmful air emissions, improve energy security, and increase operating rates and levels of capital investment in energy intensive industries.

- Public and private policy makers should remove barriers to using a diverse portfolio of natural gas contracting structures and hedging options. Long-term contracts and hedging programs are valuable tools to manage natural gas price risk. Policies, including tax measures and accounting rules, that unnecessarily restrict the use or raise the costs of these risk management tools should be avoided.

- The National Association of Regulatory Utility Commissioners (NARUC) should consider the merits of diversified natural gas portfolios, including hedging and longer-term natural gas contracts, building on its 2005 resolution. Specifically, NARUC should examine:

- Whether the current focus on shorter-term contracts, first-of-the-month pricing provisions and spot market prices supports the goal of enhancing price stability for end users,

- The pros and cons of long-term contracts for regulators, regulated utilities and their customers,

- The regulatory risk issues associated with long-term contracts and the issues of utility commission pre-approval of long-term contracts and the look-back risk for regulated entities, and

- State practices that limit or encourage long-term contracting.

- As the Commodity Futures Trading Commission (CFTC) implements financial reform legislation, including specifically Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Pub. L. 111-203), the CFTC should preserve the ability of natural gas end users to cost effectively utilize the derivatives markets to manage their commercial risk exposure. In addition, the CFTC should consider the potential impact of any new rulemaking on liquidity in the natural gas derivatives market, as reduced liquidity could have an adverse affect on natural gas price stability.

- Policy makers should recognize the important role of natural gas pipeline and storage infrastructure and existing import infrastructure in promoting stable gas prices. Policies to support the development of a fully functional and safe gas transmission and storage infrastructure both now and in the future, including streamlined regulatory approval and options for market-based rates for new storage in the United States, should be continued.

“The fact that a diverse Task Force like this could reach a consensus on these particular findings and recommendations was unexpected,” said Task Force co-Chair Gregory C. Staple, CEO of ACSF. “This consensus suggests that, although we may have a stalemate on many other energy issues, there is at least one important area — natural gas — where progress is within reach.”

With storage and potential import capacity at a record high, the Task Force predicted a relatively stable price horizon for natural gas through the next decade. Greater use of long-term contracts and other hedging arrangements are recommended to mitigate remaining price variability. Federal and state regulators are urged to avoid measures that limit these financial tools.

The Task Force members represent natural gas producers and distributors, consumer groups and large industrial users, as well as independent experts, state regulatory commissions and environmental groups. During the yearlong work, the Task Force commissioned 11 background papers from leading industry and academic experts.

Interest has grown recently in natural gas as a cleaner, low-carbon, low-cost alternative to other fossil fuels in the electric power and industrial sectors. In his State of the Union address, President Obama called for a federal clean energy standard for generating electricity that could be fulfilled through the use of natural gas.

Task Force Members

Sponsoring Task Force Members

Gregory C. Staple

Task Force Co-Chair

Chief Executive Officer

American Clean Skies Foundation

Norm Szydlowski

Task Force Co-Chair

Bipartisan Policy Center;

President & CEO

SemGroup Corporation

Ken Bromfield

U.S. Commercial Director, Energy Business

The Dow Chemical Company

Carlton Buford

Lead Economist,

The Williams Companies

Peter Sheffield

Vice President, Energy Policy and

Government Affairs

Spectra Energy Corporation

Ralph Cavanagh

Senior Attorney and Co-Director,

Energy Program

Natural Resources Defense Council

Paula Gant

Senior Vice President for Policy and Planning

American Gas Association and on behalf of the

American Gas Foundation

Carl Haga

Director, Gas Services

Southern Company

Byron Harris

Director

West Virginia Consumer Advocate Division

Marianne Kah

Chief Economist, Planning and Strategy

ConocoPhillips

Todd Strauss

Senior Director, Energy Policy, Planning

and Analysis

Pacific Gas & Electric Company

Additional Task Force Members

Colette Honorable

Chairman

Arkansas Public Service Commission

Sharon Nelson

Former Chair, Board of Directors

Consumers Union

Sue Tierney

Managing Principal

Analysis Group, Inc.;

Former Assistant Secretary of Energy

Bill Wince

Vice President, Transportation and Business Development

Chesapeake Energy Marketing

Marty Zimmerman

Professor

Ross School of Business

University of Michigan;

Former Group Vice President, Corporate Affairs,

Ford Motor Company

In The Press

Natural Gas Now Viewed as Safer Bet: New York Times, March 21 2011.

Congressmen Reed and Boren Hail Study on Natural Gas Markets: March 31 2011

NATURAL GAS: Utilities must embrace long-term contracts, market forces: E&E News, March 22 2011

Task Force: Shales, Price Stability Keys to Growing Gas Role: NGI’s Shale Daily, March 23 2011

US Faces ‘Good Problem’ as Gas Glut Stabilizes Prices: SNL Energy Finance Daily, March 24 2011.

Task Force: Dodd-Frank Could Impede Risk Management, Hedging: SNL, March 23 2011.

Stable price remains the key to shifting power sector from coal to natural gas: ClimateWire, March 23 2011

Report calls for increased use of natural gas: NewsOK, March 23 2011

Task force recommends natural gas shift: TulsaWorld, March 23 2011

Shale revolution enabling regulators to fight gas price volatility: SNL Natural Gas Report, February 15 2011.

Commissioned Papers

Natural Gas Price Volatility: Lessons from Other Markets

Austin Whitman

M.J. Bradley & Associates, LLC

The report draws lessons from markets in the U.S., Europe, and Asia to determine (1) how natural gas markets are structured in the largest consuming regions of the world, (2) the effect that exposure to natural gas prices has had on corporate performance, and (3) how natural gas price movements relate to those of other commodities.

Long-term Contracting for Natural Gas

Bruce Henning

ICF Consulting

This paper defines the objectives and elements of long-term contracts; traces the evolution of natural gas contracts; assesses the economic value of long-term contracts; analyzes the relationship between long-term contracts and natural gas price stability; and examines natural gas contracts for regulated entities.

Managing Natural Gas Price Volatility: Principles and Practices Across the Industry

Steve H. Levine and Frank C. Graves

The Brattle Group

This paper describes gas market risk characteristics; identifies risk management principles and tools for managing price volatility; describes risk management processes and controls, and analyzes limitations in managing price volatility; and compares industry hedging practices.

Staff Memo: Water Impacts Associated with Shale Gas Development

Lourdes Long

BPC Staff

How might water availability challenges constrain efforts to expand shale gas production? This memo summarizes the main water impacts associated with shale gas development in order to address this central question.

Introduction to North American Natural Gas Markets: Supply and Demand Side Drivers of Volatility Since the 1980s

Rick Smead

Navigant Consulting, Inc.

This paper examines the history of chronic natural gas price instability across three periods from 1976-2010, and identifies fundamental changes in supply and demand that could influence natural gas markets going forward.

Impact of LNG and Market Globalization

Ken Medlock

Rice University’s James Baker Institute for Public Policy

This paper seeks to answer central questions about LNG and market globalization: What are the potential impacts of North American LNG imports and exports on natural gas price volatility? Given the relative abundance of shale gas in North America, is there any reason to believe that LNG imports will rise in the coming years? In the US, how do LNG, the domestic shale gas resource, and domestic storage interact? If there are any potential adverse impacts of globalized gas trade and increased LNG imports, are there policy options available to mitigate the adverse impacts?

Abundant Shale Gas Resources, Short-Term Volatility, and Long-Term Stability of Natural Gas Prices

Stephen Brown and Alan Krupnick

Resources for the Future

This paper examines the extent to which natural gas prices are likely to remain attractive to consumers. The authors examine how the apparent abundance of natural gas and projected growth of its use might affect natural gas prices, production and consumption, using NEMS‐RFF to model a number of scenarios through 2030.

FASB Accounting Rules and Implications for Natural Gas Purchase Agreements

Bente Villadsen and Fiona Wang

The Brattle Group

An overview of FASB accounting rules and their implications for natural gas contracts; normal purchases and sales exemption and fair value accounting treatment of natural gas contracts.

Staff Memo: The Impact of EPA Utility MACT Rule on Natural Gas Demand

Jennifer Macedonia and Lourdes Long

BPC Staff

A background on the MACT Standards and the results of BPC modeling to analyze the impacts of the MACT rule on electric utility generation and natural gas demand.

Partnering with Renewables

FOR MORE INFORMATION

NATURAL GAS: A NATURAL PARTNER WITH RENEWABLES

One of the biggest advantages of using natural gas to generate electricity is its ability to be paired with renewable sources of energy, such as wind and solar. Because generating power from the sun and wind is limited by weather conditions (when the sun is shining or wind is blowing), power generated from natural gas provides an essential complement to maintain a steady flow of power to end users.

(more…)

Natural Gas Vehicles

FOR MORE INFORMATION

NATURAL GAS VEHICLES (NGVs): An Economical and Clean Alternative

Natural gas can also be compressed and used to fuel the internal combustion engines used in cars, trucks and buses.

- Reduce carbon monoxide emissions 90%-97%

- Reduce nitrogen oxide emissions 35%-60%

- Potentially reduce non-methane hydrocarbon emissions 50%-75%

- Emit fewer toxic and carcinogenic pollutants

- Emit little or no particulate matter

Natural Gas Supply

FOR MORE INFORMATION

The scope of North America’s future natural gas supplies is summarized in a 2009 briefing paper

that was commissioned by the Foundation. The report, by Navigant Consulting, draws on that group’s landmark 2008 survey of shale gas production.

A Look Back: Early History

The discovery of natural gas dates back to the ancient Chinese, who dug down thousands of feet and installed bamboo pipes. Many years later, in the seventh century CE, natural gas transported through secret pipes fueled “eternal fires” in temples near the Caspian Sea.

Natural Gas Basics

FOR MORE INFORMATION

What is natural gas? Natural gas is a naturally occurring fossil fuel that can be found in various underground rock formations worldwide, formed millions of years ago from the decaying remains of plants and animals. When it is extracted, natural gas is odorless, colorless and tasteless, and is composed mainly of methane.

Methane is clean burning and chemically simple. It has four hydrogen atoms and only one carbon atom, unlike most carbon-rich fuels such as coal, wood and oil. Natural gas is also the only fossil fuel that does not leave a residue when burned and, given its chemical composition, releases far less carbon dioxide compared to other fossil fuels.

(more…)

MIT Future of Gas Study

In 2008, the Foundation agreed to underwrite a comprehensive new two-year study by the Massachusetts Institute of Technology (MIT) faculty on the role of natural gas in the United States energy future. The study is designed to provide a detailed assessment of the supply of natural gas both in the U.S. and overseas over the mid to longer term, and to examine the potential sources of demand for natural gas during this time frame.

This study, which will be completed in the Summer of 2010, will augment MIT’s prior reports on The Future of Coal (2007) and The Future of Nuclear Power (2003).

The study is being directed by Dr. Ernest Moniz, Director of the MIT Energy Initiative, and Melanie Kenderdine, Associate Director.

The work of the MIT study team is also overseen by an independent Advisory Board whose members include:

|

|

Managing NatGas Price Volatility

p>ACSF and the National Commission on Energy Policy (NCEP) are co-sponsoring a 16-month Task Force to develop new government and private sector options for managing natgas price volatility.

America’s growing natural gas resource base is now widely recognized. Yet, the development of these resources, especially unconventional shale gas “plays”, will depend on sustained long term demand from end-users at prices that are sufficient to cover upstream production and transport costs. Whether or not this demand will be forthcoming – and at a sufficient price level – is now the subject of considerable debate.

Copenhagen Forum

The Foundation, together with the Worldwatch Institute and the UN Foundation, brought natural gas to the center of climate policy discussions in Copenhagen during the landmark UN negotiations for a new global climate change treaty in December 2009. These negotiations are formally known as the 15th Conference of the Parties (COP-15) to the UN Convention on Climate Change (UNFCC). The initiative will highlight the potential of natural gas to contribute to near- and medium-term emission reductions.

Climate Change Legislation

Because natural gas can generate electricity with 50% less CO2 than coal, the expanded use of natural gas could be a “game changer” for U.S. climate action.

However, the cap-and-trade bills now before the Congress do not give priority to increasing the power sector’s use of natural gas. We think that is a mistake and have developed a natgas incentive program that would address this shortcoming.