Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Our new report finds that a transition to natural gas-fueled heavy duty and light duty vehicles over the next decade will have a minimal impact on natural gas prices. The report uses three scenarios to calculate potential natural gas demand and price impacts attributable to natural gas vehicles (NGVs).

Full Report

Download PDF • Request Print Copy

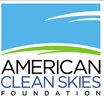

- Figure 5: Price Components of Retail CNG

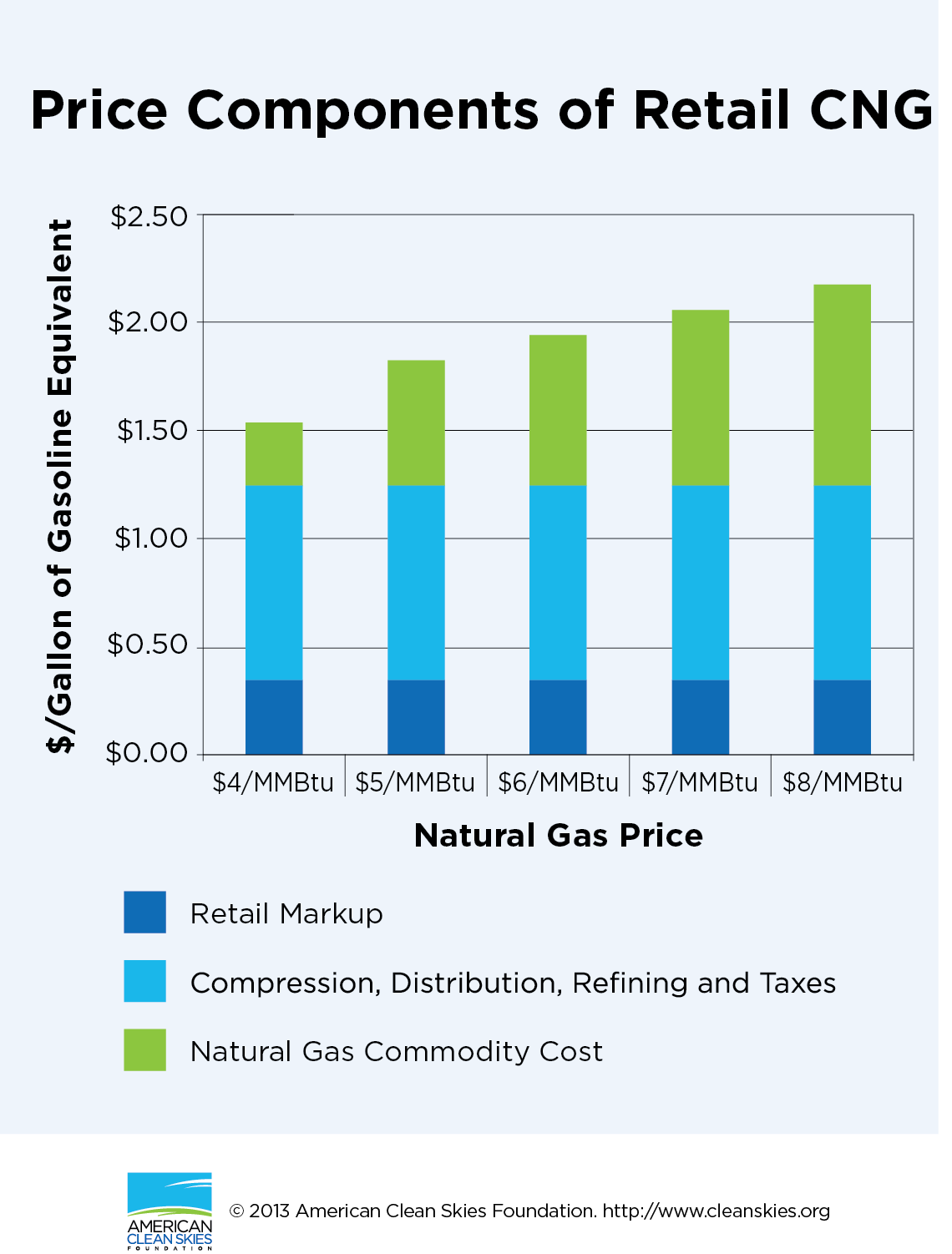

- Figure 1: Natural Gas Demand, Transportation vs. Power Generation

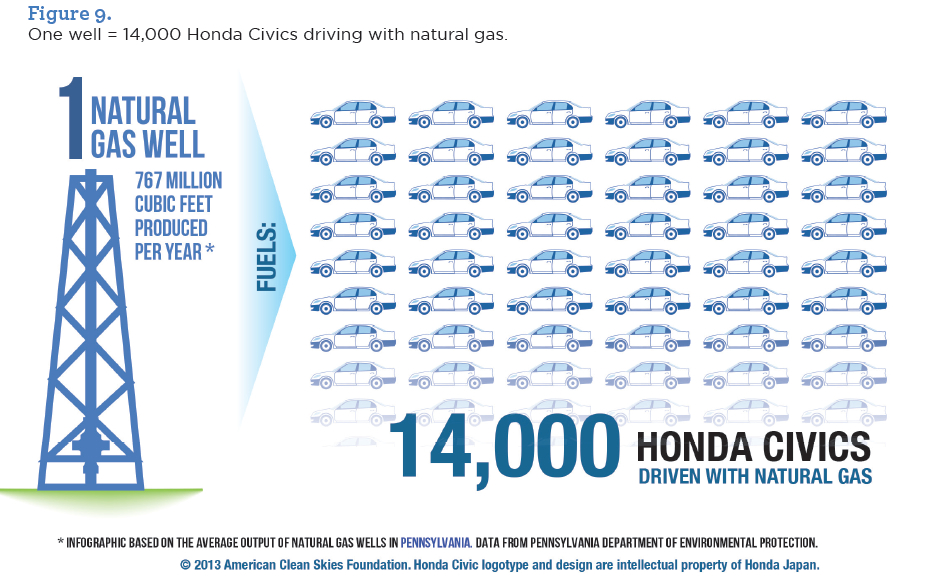

- Figure 9: One Well=14,000 Honda Civics Driving with Natural Gas

Power Switch: A No Regrets Guide to Expanding Natural Gas-Fired Electricity Generation

Download the full report here (PDF) | Order a Print Copy

Executive Summary

This report describes a practical “no regrets” plan for U.S. power companies and regulators to take advantage of the lowest natural gas prices in a decade to provide electric ratepayers with cleaner and more affordable power for years to come.

The plan has two main components:

- A new set of long-term gas purchase agreements (and associated hedging arrangements) that share some of the risk of future price changes between natural gas suppliers, on the one hand, and power generators and consumers, on the other. These new agreements would be designed to provide mutually beneficial incentives for gas suppliers and power generators to do business. For example, suppliers and generators could agree to a fixed price for a portion of the fuel, with the balance priced at the market rate.

- A level, non-discriminatory playing field for regulatory review and approval of “prudent” long-term natural gas supply agreements. This would allow regulators to judge options for gas-fired power generation on a fair and level basis vis-à-vis other power sources that routinely make use of long-term supply agreements (e.g., coal, renewables).

This report finds that the economic benefits of locking in record-low prices for natural gas may total tens of billions of dollars. These potential savings are akin to the very large benefits that homeowners and businesses can realize by refinancing mortgages and long-term debt at today’s historically low interest rates.

In 2009, natural gas-fired power plants accounted for 23 percent of national electricity production. A subsequent sharp decline in the price of natural gas —largely triggered by the unprecedented growth of shale gas production— has since led to a substantial increase in gas-fired power generation such that gas is expected to account for approximately 31 percent of the market in 2012.[1] Modern natural gas plants, especially combined cycle gas turbine (CCGT) facilities, are now cheaper to run than many coal-fired power plants. This has delivered savings for ratepayers as well as significant environmental benefits because gas-fired plants also emit less harmful air pollution. However, this report suggests that current benefits may be short lived. Unless key changes to commercial and regulatory frameworks are established at the state level, longer-term, large- scale fuel shifts by existing power plants and commitments to new gas-fired capacity are at risk.

Shale gas development has prompted some controversy, particularly in regards to potential environmental impacts. Environmental risks and associated price impacts, however, are manageable with existing technologies and best practices. Responsible development of natural gas resources is necessary to sustain a successful, no-regrets transition to affordable gas in the electric sector.

The new plan outlined in this report will require at least five major groups of stakeholders to be involved:

- Natural gas suppliers, including major producers and marketing groups, must be willing to offer viable, multi-year pricing agreements for a portion of their inventory; they must also be willing to share some of the risk of future price changes.

- Utilities and merchant generators must be willing to consider prudent, multi-year pricing agreements for a portion of their fuel needs; and they must be willing to share some of the risk of future price changes.

- Regulators and state governments must adopt a regulatory framework for the approval of prudent, long-term fuel-supply agreements that does not discriminate against natural gas. In addition, regulators must be willing to closely scrutinize any new short-term natural gas supply agreements and should reconsider the automatic pass-through of spot market fuel costs absent a showing that longer-term arrangements are not a more prudent course of action.

- Consumer advocates must be willing to support prudent, long-term natural gas supply arrangements before state regulatory bodies and legislatures where such arrangements, notwithstanding some price risks, can be expected to deliver significant long-term rate benefits.

- Natural gas pipelines and pipeline regulators must be willing to work with power plant operators to agree on appropriate transport tariffs for natural gas purchased under new, multi-year pricing arrangements.

We do not recommend that generators rely solely on long-term agreements for their gas requirements, nor should gas suppliers sell gas solely in these fashions. Instead, we believe generators and natural gas producers should supplement their current strategies with long- term agreements as a way to reduce costs and risks while increasing resource diversity and supply certainty.

This report presents the economic case for fuel switching based on three analyses: a “busbar” analysis of the comparative construction and operating costs of gas-fired plants vis-à-vis competitors; illustrative power plant retirement reviews based on different fuel costs; and a “minimax regret” analysis that evaluates risks associated with fuel procurement strategies, such as the innovative risk-sharing arrangements recommended in this report. Details of each analysis are provided in the appendices.