Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Our new report finds that a transition to natural gas-fueled heavy duty and light duty vehicles over the next decade will have a minimal impact on natural gas prices. The report uses three scenarios to calculate potential natural gas demand and price impacts attributable to natural gas vehicles (NGVs).

Full Report

Download PDF • Request Print Copy

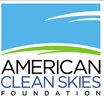

- Figure 5: Price Components of Retail CNG

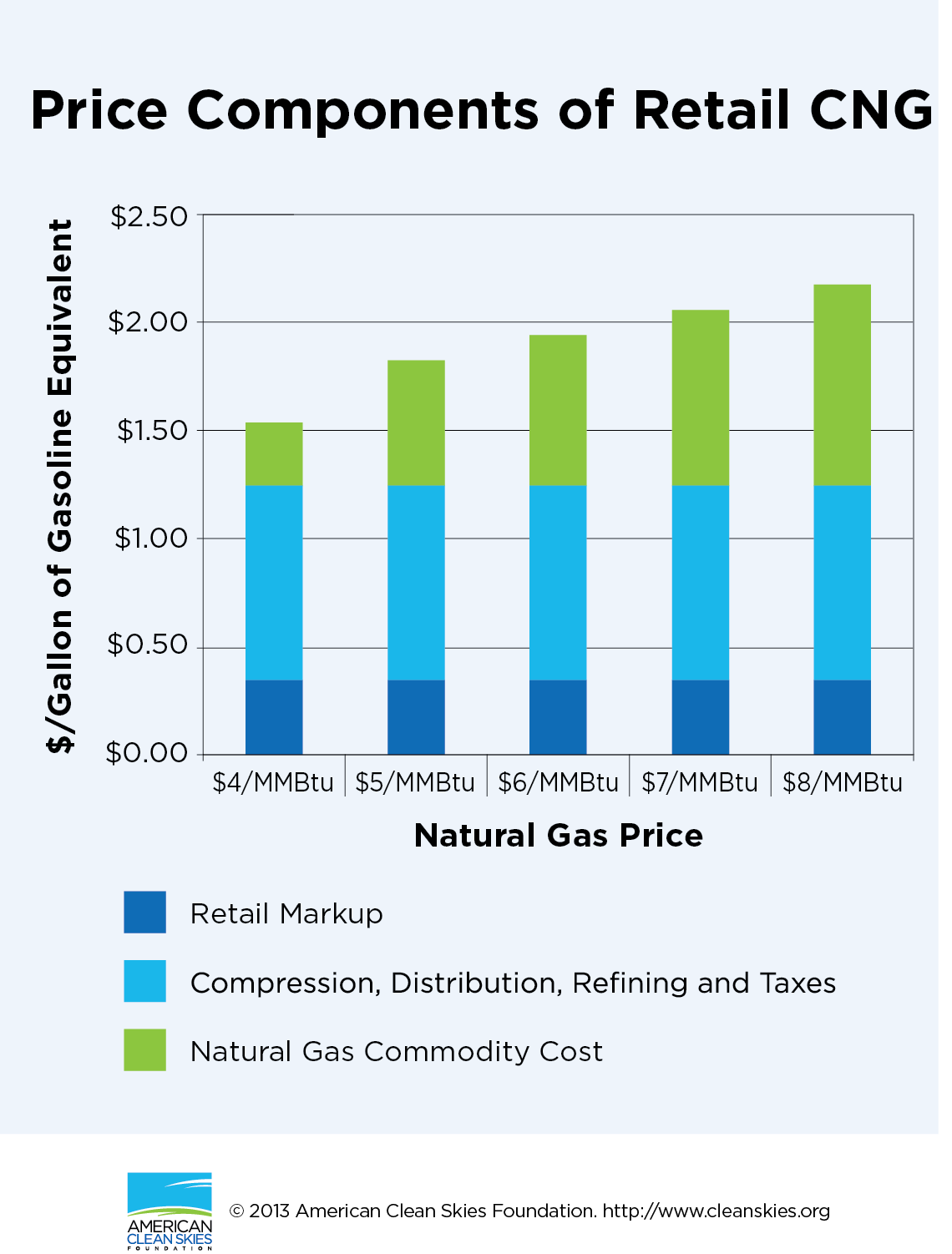

- Figure 1: Natural Gas Demand, Transportation vs. Power Generation

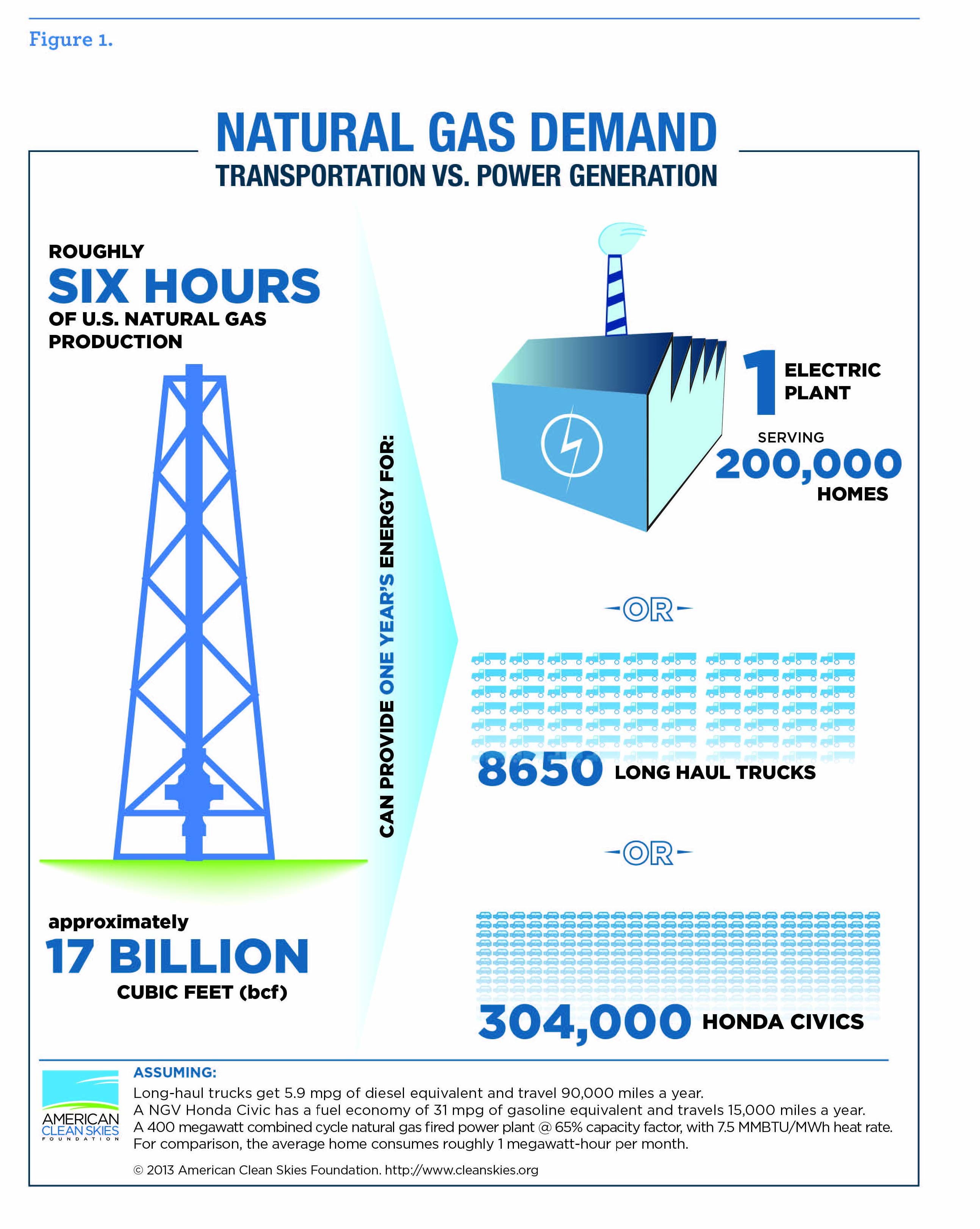

- Figure 9: One Well=14,000 Honda Civics Driving with Natural Gas

ACSF, Moniz Team Up for “Future of Natural Gas”

The Future of Natural Gas: An Interdisciplinary MIT Study

ACSF and several other groups initiated and sponsored the report. The other groups included the MIT Energy Initiative (MITEI) members Hess Corporation and Agencia Naçional de Hidrocarburos (Colombia), the Gas Technology Institute (GTI), Exelon, and an anonymous donor. Gregory C. Staple, the Foundation’s CEO, served on the report’s 18-person advisory committee. Incoming Energy Secretary Ernest J. Moniz, former MITEI director, testified before the U.S. Senate Committee on Energy and Natural Resources about this report.

Full Report

Download PDF • Request Print Copy

In the Press

Ernest Moniz, MIT Physicist, Nominated as Energy Secretary: The Washington Post, March 4, 2013

An M.I.T. Plan for Natural Gas with Planet in Mind: New York Times, June 9, 2011

MIT: Natural Gas to Become More Entwined in US Economy: SNL Financial, June 9, 2011

Natural Gas Gives Edge to US Manufacturers: Financial Times, June 8, 2011

The Future of Natural Gas: Geology.com, June 28, 2010

Does Our Energy Future Line in Natural Gas?: Consumer Affairs, June 28, 2010

The Future of Natural Gas: RedOrbit, June 28, 2010

Offshore Drilling Uncertainty Likely to Boost Search for Onshore Deposits: allvoices, June 28, 2010

Study Says Natural Gas Use Likely to Double: New York Times, June 25, 2010

MIT Study Urges US Gas Industry to Back Price on Carbon Emissions: Platts, June 25, 2010

For Climate Relief, US Will Turn to Gas: Nature.com, June 25, 2010

MIT Researchers See Natural Gas as the Choice for Lower Carbon Emissions: New York Times, June 25, 2010

MIT: The Future Is A (Natural) Gas: Forbes, June 25, 2010

Natural Gas Seen as Key in a Carbon-Constrained Futuree: Greentech Media, June 25, 2010

MIT Releases Major Report: The Future of Natural Gas: PhysOrg.com, June 25, 2010

MITEI-Led Study Offers Comprehensive Look at The Future of Natural Gas: MIT News, June 25, 2010

Natural Gas Use to Double in US in Coming Decades: MIT Report: Treehugger, June 25, 2010

European Views On American Natural Gas Exports

This strategic primer highlights the joint economic and security interests the United States and Europe have regarding the export of liquefied natural gas (LNG). It details the major transatlantic connections underlying the export debate.

Full Report

Download PDF • Request Print Copy

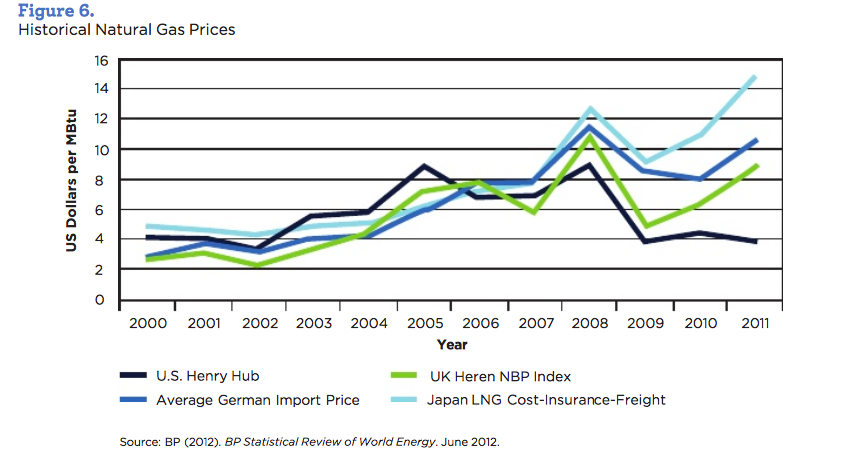

- Figure 6: Historical Natural Gas Prices

European Views on American Natural Gas Exports

Where Can I Fill Up? 2013 Update

Where Can I Fill Up? 2013 Assessment

This updated edition of Where Can I Fill Up? expands on the information in the August 2012 report. It provides more than 20 pages of new information on who is building NGV fueling infrastructure, along with more detail on where and how this infrastructure is being added and government policies pertaining to the development of NGV fueling infrastructure.

Where Can I Fill Up?

This new 60 page ACSF report provides a comprehensive up-to-date survey of private sector and state government initiatives to build out natural gas vehicle (NGV) fueling stations across America. It covers investments in new CNG and LNG facilities and contains detailed state-by-state profiles of incentives (tax credits, loans, grants, public utility programs) now available to promote NGV infrastructure.

Politico 2012: Shale Gas Rocks The Economy…And Politics

During the recent Republican and Democratic presidential nominating conventions, ACSF distributed more than 60,000 copies of a special eight-page newspaper supplement about America’s shale gas story and the Foundation’s policy work. This unique advertising supplement was prepared by ACSF in conjunction with the Washington D.C.-based Politico newspaper and was inserted in the local Tampa Bay Times and Charlotte Observer newspapers provided to all convention participants. More than 30,000 copies of the supplement were also distributed in Washington D.C. as part of a post-convention issue of Politico.

Tech Effect: How Innovation in Oil and Gas Exploration is Spurring the U.S. Economy

By E. Harry Vidas, Vice President, ICF International.

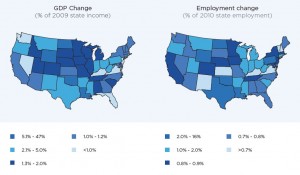

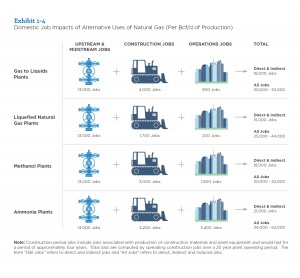

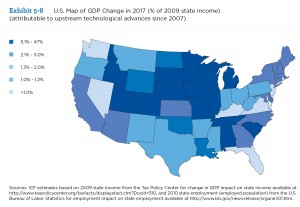

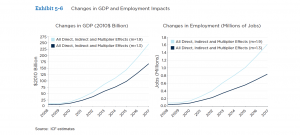

This new ACSF report shows that shale gas and tight oil production will add $167 billion to $245 billion to the U.S. gross domestic product by 2017, and that will deliver 835,000 to 1.6 million new jobs. This is only one of the many ways technological innovations in natural gas and tight oil production are transforming the U.S. economy.

Download Full Report (PDF) | Read Executive Summary | Request Print Copy

Full Report

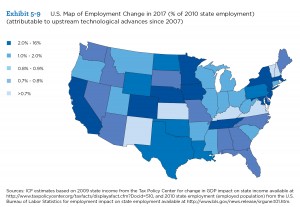

- Exhibit 1-1 U.S. Map of GDP and Employment Impacts

- Exhibit 1-4 Domestic Job Impacts of Alternative Uses of Natural Gas

- Exhibit 2-2: Map of Lower US Shale Plays

- Exhibit 5-8 U.S. Map of GDP Change in 2017

- Exhibit 5-9 U.S. Map of Employment Change in 2017

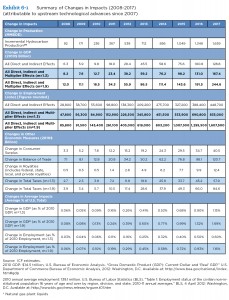

- Exhibit 6-1: Summary of Change in Impacts

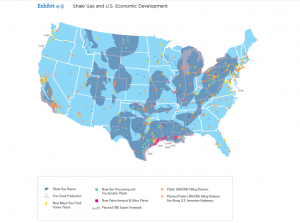

- Exhibit 4-3 Shale Gas and U.S. Economic Development

- Exhibit 5-6 Changes in GDP and Employment Impacts

Shale Gas Powers the Country

This map was originally published in Politico’s presidential nominating convention newspapers.

Data Sources

- Shale Gas Basins: Energy Information Administration, May 9, 2011, http://www.eia.gov/oil_gas/rpd/shale_gas.pdf

- Frac Sand Production: ICF International.

- New Major Gas-Fired Power Plants: SNL Financial, accessed June 12, 2012.

- Included are all planned natural gas-fired power plants with construction costs estimated to exceed $100,000,000.

- New Gas Processing and Fractionation Plants: Oil and Gas Journal, May 7, 2012.

- New Petrochemical and Other Plants: ICF International

- Existing and Planned Public LNG/CNG Filing Stations: Department of Energy, Alternative Fuels and Advanced Vehicles Data Center, accessed June 1, 2012, http://www.afdc.energy.gov/afdc/fuels/stations.html

- Included are all existing and planned public CNG and LNG fueling stations (no private/fleet only fueling stations).

- Planned LNG Export Terminals: Federal Energy Regulatory Commission, July 17, 2012, http://ferc.gov/industries/gas/indus-act/lng/LNG-proposed-potential.pdf and http://www.ferc.gov/industries/gas/indus-act/lng/LNG-approved.pdf

- Included are all export terminals that are either approved and under construction or proposed to the FERC.

Where Can I Fill Up?

National Producer-Consumer Task Force Sees Promise In More Stable Natural Gas Prices

Findings & Recommendations | Full Report (PDF) | Task Force Members | Original Commissioned Research | In the Press

On March 22, the American Clean Skies Foundation and the Bipartisan Policy Center released the final report of a jointly convened task force of environmentalists, consumer advocates and natural gas users that looked at natural gas markets.

Read the complete 70-page report (Adobe PDF document, ~5MB).

Key Task Force Findings and Recommendations

- Recent developments allowing for the economic extraction of natural gas from shale formations reduce the susceptibility of gas markets to price instability and provide an opportunity to expand the efficient use of natural gas in the United States.

- Government policy at the federal, state and municipal level should encourage and facilitate the development of domestic natural gas resources, subject to appropriate environmental safeguards. Balanced fiscal and regulatory policies will enable an increased supply of natural gas to be brought to market at more stable prices. Conversely, policies that discourage the development of domestic natural gas resources, that discourage demand, or that drive or mandate inelastic demand will disrupt the supply-demand balance, with adverse effects on the stability of natural gas prices and investment decisions by energy-intensive manufacturers.

- The efficient use of natural gas has the potential to reduce harmful air emissions, improve energy security, and increase operating rates and levels of capital investment in energy intensive industries.

- Public and private policy makers should remove barriers to using a diverse portfolio of natural gas contracting structures and hedging options. Long-term contracts and hedging programs are valuable tools to manage natural gas price risk. Policies, including tax measures and accounting rules, that unnecessarily restrict the use or raise the costs of these risk management tools should be avoided.

- The National Association of Regulatory Utility Commissioners (NARUC) should consider the merits of diversified natural gas portfolios, including hedging and longer-term natural gas contracts, building on its 2005 resolution. Specifically, NARUC should examine:

- Whether the current focus on shorter-term contracts, first-of-the-month pricing provisions and spot market prices supports the goal of enhancing price stability for end users,

- The pros and cons of long-term contracts for regulators, regulated utilities and their customers,

- The regulatory risk issues associated with long-term contracts and the issues of utility commission pre-approval of long-term contracts and the look-back risk for regulated entities, and

- State practices that limit or encourage long-term contracting.

- As the Commodity Futures Trading Commission (CFTC) implements financial reform legislation, including specifically Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (Pub. L. 111-203), the CFTC should preserve the ability of natural gas end users to cost effectively utilize the derivatives markets to manage their commercial risk exposure. In addition, the CFTC should consider the potential impact of any new rulemaking on liquidity in the natural gas derivatives market, as reduced liquidity could have an adverse affect on natural gas price stability.

- Policy makers should recognize the important role of natural gas pipeline and storage infrastructure and existing import infrastructure in promoting stable gas prices. Policies to support the development of a fully functional and safe gas transmission and storage infrastructure both now and in the future, including streamlined regulatory approval and options for market-based rates for new storage in the United States, should be continued.

“The fact that a diverse Task Force like this could reach a consensus on these particular findings and recommendations was unexpected,” said Task Force co-Chair Gregory C. Staple, CEO of ACSF. “This consensus suggests that, although we may have a stalemate on many other energy issues, there is at least one important area — natural gas — where progress is within reach.”

With storage and potential import capacity at a record high, the Task Force predicted a relatively stable price horizon for natural gas through the next decade. Greater use of long-term contracts and other hedging arrangements are recommended to mitigate remaining price variability. Federal and state regulators are urged to avoid measures that limit these financial tools.

The Task Force members represent natural gas producers and distributors, consumer groups and large industrial users, as well as independent experts, state regulatory commissions and environmental groups. During the yearlong work, the Task Force commissioned 11 background papers from leading industry and academic experts.

Interest has grown recently in natural gas as a cleaner, low-carbon, low-cost alternative to other fossil fuels in the electric power and industrial sectors. In his State of the Union address, President Obama called for a federal clean energy standard for generating electricity that could be fulfilled through the use of natural gas.

Task Force Members

Sponsoring Task Force Members

Gregory C. Staple

Task Force Co-Chair

Chief Executive Officer

American Clean Skies Foundation

Norm Szydlowski

Task Force Co-Chair

Bipartisan Policy Center;

President & CEO

SemGroup Corporation

Ken Bromfield

U.S. Commercial Director, Energy Business

The Dow Chemical Company

Carlton Buford

Lead Economist,

The Williams Companies

Peter Sheffield

Vice President, Energy Policy and

Government Affairs

Spectra Energy Corporation

Ralph Cavanagh

Senior Attorney and Co-Director,

Energy Program

Natural Resources Defense Council

Paula Gant

Senior Vice President for Policy and Planning

American Gas Association and on behalf of the

American Gas Foundation

Carl Haga

Director, Gas Services

Southern Company

Byron Harris

Director

West Virginia Consumer Advocate Division

Marianne Kah

Chief Economist, Planning and Strategy

ConocoPhillips

Todd Strauss

Senior Director, Energy Policy, Planning

and Analysis

Pacific Gas & Electric Company

Additional Task Force Members

Colette Honorable

Chairman

Arkansas Public Service Commission

Sharon Nelson

Former Chair, Board of Directors

Consumers Union

Sue Tierney

Managing Principal

Analysis Group, Inc.;

Former Assistant Secretary of Energy

Bill Wince

Vice President, Transportation and Business Development

Chesapeake Energy Marketing

Marty Zimmerman

Professor

Ross School of Business

University of Michigan;

Former Group Vice President, Corporate Affairs,

Ford Motor Company

In The Press

Natural Gas Now Viewed as Safer Bet: New York Times, March 21 2011.

Congressmen Reed and Boren Hail Study on Natural Gas Markets: March 31 2011

NATURAL GAS: Utilities must embrace long-term contracts, market forces: E&E News, March 22 2011

Task Force: Shales, Price Stability Keys to Growing Gas Role: NGI’s Shale Daily, March 23 2011

US Faces ‘Good Problem’ as Gas Glut Stabilizes Prices: SNL Energy Finance Daily, March 24 2011.

Task Force: Dodd-Frank Could Impede Risk Management, Hedging: SNL, March 23 2011.

Stable price remains the key to shifting power sector from coal to natural gas: ClimateWire, March 23 2011

Report calls for increased use of natural gas: NewsOK, March 23 2011

Task force recommends natural gas shift: TulsaWorld, March 23 2011

Shale revolution enabling regulators to fight gas price volatility: SNL Natural Gas Report, February 15 2011.

Commissioned Papers

Natural Gas Price Volatility: Lessons from Other Markets

Austin Whitman

M.J. Bradley & Associates, LLC

The report draws lessons from markets in the U.S., Europe, and Asia to determine (1) how natural gas markets are structured in the largest consuming regions of the world, (2) the effect that exposure to natural gas prices has had on corporate performance, and (3) how natural gas price movements relate to those of other commodities.

Long-term Contracting for Natural Gas

Bruce Henning

ICF Consulting

This paper defines the objectives and elements of long-term contracts; traces the evolution of natural gas contracts; assesses the economic value of long-term contracts; analyzes the relationship between long-term contracts and natural gas price stability; and examines natural gas contracts for regulated entities.

Managing Natural Gas Price Volatility: Principles and Practices Across the Industry

Steve H. Levine and Frank C. Graves

The Brattle Group

This paper describes gas market risk characteristics; identifies risk management principles and tools for managing price volatility; describes risk management processes and controls, and analyzes limitations in managing price volatility; and compares industry hedging practices.

Staff Memo: Water Impacts Associated with Shale Gas Development

Lourdes Long

BPC Staff

How might water availability challenges constrain efforts to expand shale gas production? This memo summarizes the main water impacts associated with shale gas development in order to address this central question.

Introduction to North American Natural Gas Markets: Supply and Demand Side Drivers of Volatility Since the 1980s

Rick Smead

Navigant Consulting, Inc.

This paper examines the history of chronic natural gas price instability across three periods from 1976-2010, and identifies fundamental changes in supply and demand that could influence natural gas markets going forward.

Impact of LNG and Market Globalization

Ken Medlock

Rice University’s James Baker Institute for Public Policy

This paper seeks to answer central questions about LNG and market globalization: What are the potential impacts of North American LNG imports and exports on natural gas price volatility? Given the relative abundance of shale gas in North America, is there any reason to believe that LNG imports will rise in the coming years? In the US, how do LNG, the domestic shale gas resource, and domestic storage interact? If there are any potential adverse impacts of globalized gas trade and increased LNG imports, are there policy options available to mitigate the adverse impacts?

Abundant Shale Gas Resources, Short-Term Volatility, and Long-Term Stability of Natural Gas Prices

Stephen Brown and Alan Krupnick

Resources for the Future

This paper examines the extent to which natural gas prices are likely to remain attractive to consumers. The authors examine how the apparent abundance of natural gas and projected growth of its use might affect natural gas prices, production and consumption, using NEMS‐RFF to model a number of scenarios through 2030.

FASB Accounting Rules and Implications for Natural Gas Purchase Agreements

Bente Villadsen and Fiona Wang

The Brattle Group

An overview of FASB accounting rules and their implications for natural gas contracts; normal purchases and sales exemption and fair value accounting treatment of natural gas contracts.

Staff Memo: The Impact of EPA Utility MACT Rule on Natural Gas Demand

Jennifer Macedonia and Lourdes Long

BPC Staff

A background on the MACT Standards and the results of BPC modeling to analyze the impacts of the MACT rule on electric utility generation and natural gas demand.

Natural Gas Vehicles

FOR MORE INFORMATION

NATURAL GAS VEHICLES (NGVs): An Economical and Clean Alternative

Natural gas can also be compressed and used to fuel the internal combustion engines used in cars, trucks and buses.

- Reduce carbon monoxide emissions 90%-97%

- Reduce nitrogen oxide emissions 35%-60%

- Potentially reduce non-methane hydrocarbon emissions 50%-75%

- Emit fewer toxic and carcinogenic pollutants

- Emit little or no particulate matter

Managing NatGas Price Volatility

p>ACSF and the National Commission on Energy Policy (NCEP) are co-sponsoring a 16-month Task Force to develop new government and private sector options for managing natgas price volatility.

America’s growing natural gas resource base is now widely recognized. Yet, the development of these resources, especially unconventional shale gas “plays”, will depend on sustained long term demand from end-users at prices that are sufficient to cover upstream production and transport costs. Whether or not this demand will be forthcoming – and at a sufficient price level – is now the subject of considerable debate.