Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Driving on Natural Gas: Fuel Price and Demand Scenarios for Natural Gas Vehicles to 2025

Our new report finds that a transition to natural gas-fueled heavy duty and light duty vehicles over the next decade will have a minimal impact on natural gas prices. The report uses three scenarios to calculate potential natural gas demand and price impacts attributable to natural gas vehicles (NGVs).

Full Report

Download PDF • Request Print Copy

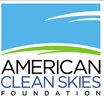

- Figure 5: Price Components of Retail CNG

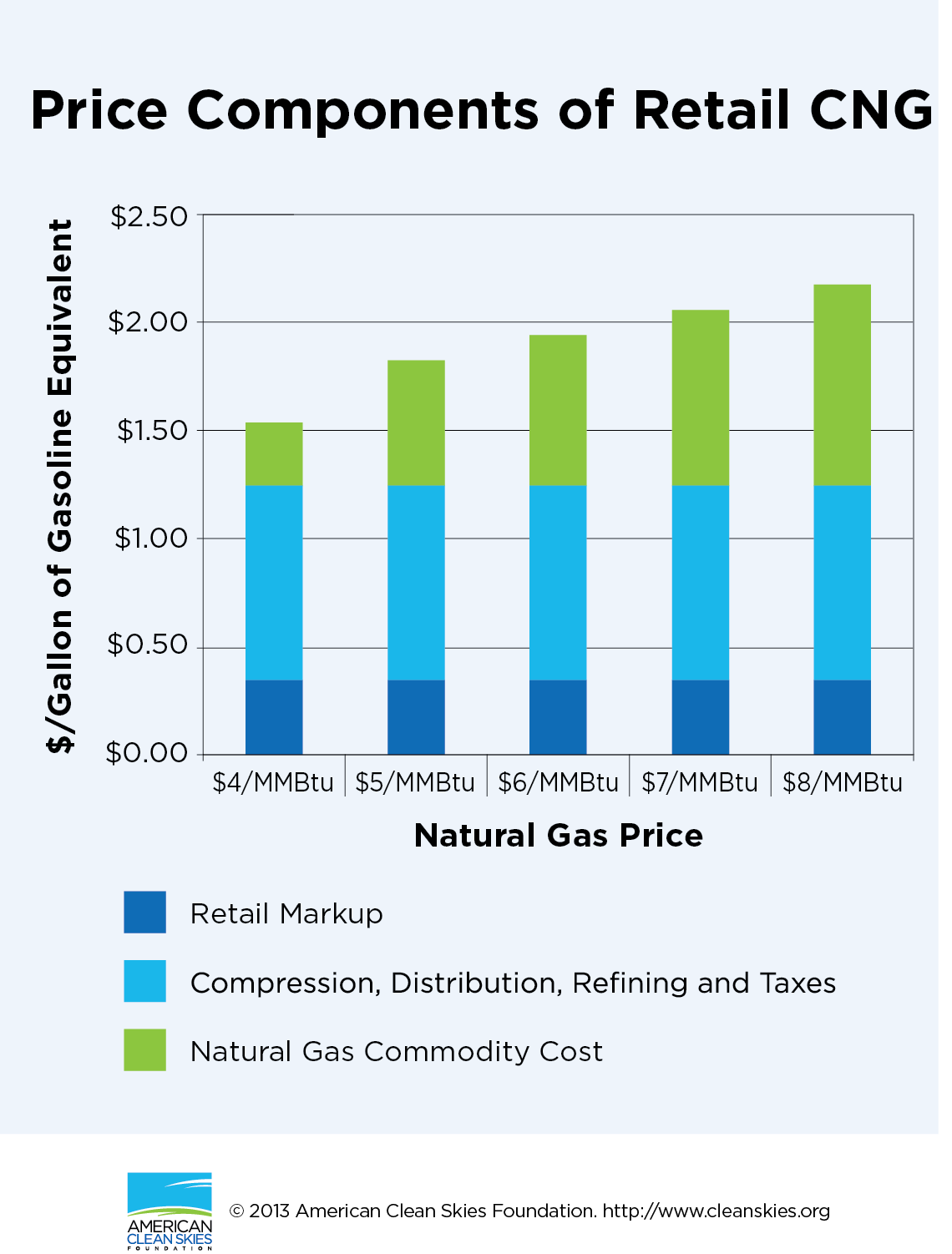

- Figure 1: Natural Gas Demand, Transportation vs. Power Generation

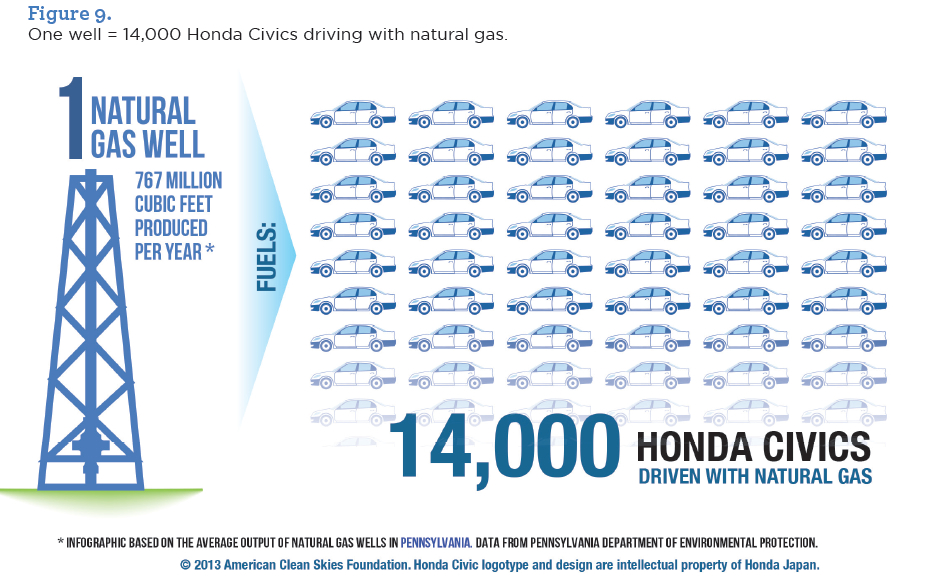

- Figure 9: One Well=14,000 Honda Civics Driving with Natural Gas

A New Energy Option: North America’s New Natural Gas Resources And Their Potential Impact On Energy and Climate Security

By Gregory C. Staple Esq. and Joel L. Swerdlow, Ph.D., 2009.

Working Paper

Oil Shift: The Case for Switching Federal Transportation Spending to Alternative Fuel Vehicles

-

Get Involved

- Learn About the Contracts

- Read the Oil Shift Report (PDF)

- FAQ

- Events

- Contact Us

The GSA Agrees

The GSA recently decided to adopt provisions of our plan by including clean fuel and environmental metrics in its upcoming $1.5 billion government-wide overnight delivery contract. Read our press release, and our original letter to GSA’s Administrator.

We are helping federal agencies purchase greener, more fuel efficient, lower cost shipping and delivery services.That will put more clean trucks on the road in 2015.

How It All Began

In 2012, we launched a new campaign to cut back the level of harmful pollution associated with hauling freight and packages to and from the federal government — a $150 billion a year business.

Our landmark 2012 Oil Shift report by Gregory C. Staple and Warren G. Lavey made the case for switching federal transportation spending to alternative fuel vehicles. The report showed how the government could do that better by shifting more and more of its trucking and overnight delivery contracts to vendors that have more efficient fleets and use greater volumes of alternative non-petroleum fuels, such as natural gas and electric vehicles.

Our Oil Shift campaign has generated support from a broad range of organizations including the Electric Drive Transportation Association (EDTA), the American Council on Renewable Energy (ACORE), and the Advanced Energy Economy (AEE). We also garnered endorsements from leading environment and public health advocates.

Washington has begun to listen. First, GSA decided to adopt provisions of our plan by including clean fuel and environmental metrics in a $1.5 billion government-wide overnight delivery contract. Then, on March 19, 2015, President Obama issued a new Executive Order on federal sustainability that, among other things, includes requirements for considering environmental impacts in the future procurement decisions of the seven largest procuring agencies.

The Road Ahead

We have asked the Department of Defense to make cleaner domestic fuels a priority for its transport vendors. With your help, we can improve air quality, create more American jobs, and promote energy independence.

The Electric Power Sector: New Federal Strategies for Cleaner Energy

“Regulations are prompting the use of cleaner, more efficient power plants, and current electric transmission planning will shape the grid that connects those plants for years to come.”

“Regulations are prompting the use of cleaner, more efficient power plants, and current electric transmission planning will shape the grid that connects those plants for years to come.”Since 2010, ACSF has docketed comments in various federal regulatory proceedings to help facilitate the use of reliable, clean power (See Better Rules to Live By, p. 9). This article highlights the role of the Federal Energy Regulatory Commission (FERC) and two sets of regulatory dockets that may shape the grid for years to come: 1) federal environmental rules and 2) interstate electric transmission planning.

Environmental Regulation and the Electric Power Sector

The electric power sector is undergoing significant change. Environmental regulations are prompting the use of cleaner, more efficient power plants. And domestic natural gas production has dramatically increased, providing an abundant, affordable, low-emitting fuel source for power plants. Intermittent renewable energy also is being increasingly deployed.

Over the last year, the U.S. Environmental Protection Agency has finalized two significant power sector rules: the Cross-State Air Pollution Rule and the Mercury and Air Toxics Standards (MATS). The first seeks to reduce power plant pollution that drifts across state lines and impedes the ability of downwind states to meet federal air quality standards. The second addresses toxic emissions of mercury and other “hazardous air pollutants.” Both of these rules have been decades in the making.

Due to the power sector’s significant emissions and relatively costly pollution control equipment, EPA power sector rules are frequently subject to litigation. The Cross-State rule and MATS are both being challenged in the DC Circuit Court of Appeals. Regardless of how the Court rules, however, at least some of the emission control measures required by these rules are likely to be upheld under the Clean Air Act. Additional EPA regulations, including for coal ash and wastewater, will likely further impact coal-fired power. Bottom line: The electric power sector is becoming increasingly clean, as many older, high-emitting coal plants either retrofit with advanced emission controls or retire.

FERC’s Role in Processing Environmental Compliance Extensions

Some power companies and regulators have raised concerns that coal plant retirements brought about by the Cross- State rule and MATS may leave the grid with insufficient power. In particular, the stringent MATS generally require compliance by 2015. However, EPA can extend the MATS compliance deadline for power plant operators on a case-by-case basis.

On January 20, FERC issued a staff white paper for public comment describing how the agency might advise EPA on extension requests under the MATS that involve closing power plants and the subsequent affect on reliability standards. In response, ACSF filed comments urging a common sense solution: power plant operators should undertake early and transparent planning for plant retirements that meaningfully involves state regulators and other stakeholders. The ACSF comments identified how FERC could act through its statutory authority over electric system reliability to undertake a more proactive approach to reliability issues. The comments identified the importance of FERC working with state regulators and other stakeholders. In a subsequent policy statement, FERC signaled its intention to continue addressing potential reliability issues and to work with states via the National Association of Regulatory Utility Commissioners/ FERC Forum on Reliability and the Environment. FERC also stated that it will continue to review relevant information submitted by other stakeholders.

In its FERC comments, ACSF alsostressed that a large number of existing gas-fired power plants are underutilized. As older coal plants retire, these underutilized gas power plants provide an obvious means of helping to provide replacement power and promote grid reliability.

Transmission Planning

FERC has also been active with respect to transmission planning and related issues. Notably FERC Order 1000 (issued on July 21, 2011) requires authorities to plan for new facilities both within a region and between regions.

ACSF has been providing input on related issues, including two studies by the Department of Energy on transmission congestion in both 2010 and 2012.

ACSF advised DOE that, given “the low emissions profile and relatively small footprint of natural gas electric generating units, these units are uniquely well-suited for siting closer to sources of electricity demand;” they, therefore, can reduce transmission congestion. Similarly, natural gas located closer to load centers can reduce the need for, costs, and environmental impacts associated with long-distance transmission.

Order 1000 and Public Policy Requirements

Order 1000 also requires transmission needs to be guided by “public policy requirements,” such as the Cross-State rule and MATS. Both renewables and low-emitting gas-fired plants can help achieve the goal of reducing power sector emissions. In particular, natural gas emits no mercury and either little or none of other major pollutants emitted by coal-fired power plants (see Clean Skies Infographic).

Furthermore, natural gas plants can be more flexible than coal-fired power plants, and can ramp generation up and down to provide support to intermittent renewable generation when the wind isn’t blowing and the sun isn’t shining. In doing so, natural gas-fired power helps states to meet their Renewable Portfolio Standards–also “public policy requirements” under order 1000.

In its FERC comments ACSF has also argued that consideration should be given to how capacity markets and compensation for ancillary services can promote the type of flexible gasfired generation.

For background on the multiple fuel sources used by power plants, view Energy 101: Electricity Generation.

On April 13, the U.S. Environmental Protection Agency proposed a significant standard to limit greenhouse gas (GHG) emissions from new fossil-fuel fired electric power plants. Power plants are the largest anthropogenic source of GHG emissions in the United States, and coal-fired power plants have particularly high levels of these emissions.

This proposed rule builds on EPA’s proposed regulation of GHG emissions from vehicles, the second largest source of these emissions.

The proposed power plant GHG rule is due to usher in a new era of direct carbon limits for new power plants.

Significantly, the proposed rule bases the GHG emission limit “on the performance of widely used natural gas combined cycle” technology. Thus, natural gas units will literally “set the standard” for fossil fuel units more broadly. To control their inherently higher GHG emissions, new coal-fired power plants would generally have to install carbon capture and storage equipment.

In proposing these power plant GHG standards, EPA recognizes natural gas as a foundation of our nation’s clean energy future. Here are some of EPA’s comments on natural gas in the proposed rulemaking docket:

- “EPA’s proposed standard reflects the ongoing trend in the power sector to build cleaner plants, including new, clean-burning, efficient natural gas generation, which is already the technology of choice for new and planned power plants.”

- “Natural gas prices have stabilized over the past few years as new drilling techniques have brought additional supply to the marketplace. As a result, natural gas prices are expected to be competitive for the foreseeable future and utilities are likely to rely heavily on natural gas to meet new demand for electricity generation.”

- “Because this standard is in line with current industry investment patterns, this proposed standard is not expected to have notable costs and is not projected to impact electricity prices or reliability.” In short, EPA emphasizes that lowcost, efficient natural gas units can provide an effective means to address GHG emissions.

Of course, low-emitting power sources, such as renewable energy, also have a key role in reducing power sector emissions. But natural gas generation, which can operate more flexibly than other generation types, also has been broadly recognized as needed to provide load-support to variable intermittent renewal energy sources.

The EPA rulemaking notice excerpted on this page can be found at: http://epa.gov/carbonpollutionstandard/actions.html.

Better Rules to Live By: ACSF Comments on Regulatory Proposals

ACSF frequently comments on regulatory proposals that impact the electric power sector, including proposals by the Federal Energy Regulatory Commission (FERC), the Department of Energy (DOE), and the Environmental Protection Agency (EPA). Our comments include:

FERC

- On February 29, 2012, ACSF commented on a staff white paper regarding FERC’s role in processing requests to extend deadlines for compliance with EPA’s stricter limits on mercury and other harmful air emissions, known as the Mercury and Air Toxics Standards (MATS). ACSF suggested adjustments to avoid unnecessary power plant reliability problems and ensure early and transparent planning that meaningfully involves state regulators and stakeholders. http://www.cleanskies.org/wp-content/uploads/2012/04/ACSFComments-FERCWhitePaper_on_MATS.pdf

- On March 2, 2011, ACSF commented on a Notice of Proposed Rulemaking on the Integration of Variable Energy Resources. ACSF’s response focused on fairly allocating costs for ancillary grid support services (such as load balancing provided by flexible fast-start natural gas fired generators) needed to accommodate more renewable energy. http://www.cleanskies.org/wp-content/uploads/2011/05/ACSF_FERC_filing_3_2_2011.pdf

EPA

- On August 4, 2011, ACSF supported EPA’s proposed MATS rule. The Foundation also urged the EPA to document how the increased use of natural gas could reduce the power sector’s emissions of mercury and other harmful pollutants covered by this rule. http://www.cleanskies.org/wp-content/uploads/2011/08/EPA-8_4_2011-filing-re-MACT.pdf

- On October 1, 2010 ACSF filed comments on EPA’s Cross-State Air Pollution Rule, in particular noting that EPA’s proposed emission-based allocation method unduly favored high-polluting units. EPA recognized this critique and subsequently changed the allocation method. http://www.cleanskies.org/wp-content/uploads/2012/05/acsf_comments_CATR_10012010.pdf

DOE

- On January 30, 2012, ACSF filed comments on DOE’s forthcoming transmission congestion study and urged DOE to take into account future increases in gas-fired generation. ACSF noted that gas-fired units can be located close to load and, thus, can provide a key means of alleviating transmission constraints. http://1.usa.gov/MBDCqh

- On October 29, 2010, ACSF supported DOE’s adoption of full fuel-cycle measures for benchmarking the energy efficiency of consumer appliances and urged more widespread use of fuel-cycle principles. Taking into account the full fuel cycle helps to provide the public more complete information on greenhouse gas footprints. http://cleanskies.org/pdf/ACSF_Comments_on_Full_Fuel_Cycle_filing_10

ACSF’s complete comments can be found here.

Power Switch: A No Regrets Guide to Expanding Natural Gas-Fired Electricity Generation

Download the full report here (PDF) | Order a Print Copy

Executive Summary

This report describes a practical “no regrets” plan for U.S. power companies and regulators to take advantage of the lowest natural gas prices in a decade to provide electric ratepayers with cleaner and more affordable power for years to come.

The plan has two main components:

- A new set of long-term gas purchase agreements (and associated hedging arrangements) that share some of the risk of future price changes between natural gas suppliers, on the one hand, and power generators and consumers, on the other. These new agreements would be designed to provide mutually beneficial incentives for gas suppliers and power generators to do business. For example, suppliers and generators could agree to a fixed price for a portion of the fuel, with the balance priced at the market rate.

- A level, non-discriminatory playing field for regulatory review and approval of “prudent” long-term natural gas supply agreements. This would allow regulators to judge options for gas-fired power generation on a fair and level basis vis-à-vis other power sources that routinely make use of long-term supply agreements (e.g., coal, renewables).

This report finds that the economic benefits of locking in record-low prices for natural gas may total tens of billions of dollars. These potential savings are akin to the very large benefits that homeowners and businesses can realize by refinancing mortgages and long-term debt at today’s historically low interest rates.

In 2009, natural gas-fired power plants accounted for 23 percent of national electricity production. A subsequent sharp decline in the price of natural gas —largely triggered by the unprecedented growth of shale gas production— has since led to a substantial increase in gas-fired power generation such that gas is expected to account for approximately 31 percent of the market in 2012.[1] Modern natural gas plants, especially combined cycle gas turbine (CCGT) facilities, are now cheaper to run than many coal-fired power plants. This has delivered savings for ratepayers as well as significant environmental benefits because gas-fired plants also emit less harmful air pollution. However, this report suggests that current benefits may be short lived. Unless key changes to commercial and regulatory frameworks are established at the state level, longer-term, large- scale fuel shifts by existing power plants and commitments to new gas-fired capacity are at risk.

Shale gas development has prompted some controversy, particularly in regards to potential environmental impacts. Environmental risks and associated price impacts, however, are manageable with existing technologies and best practices. Responsible development of natural gas resources is necessary to sustain a successful, no-regrets transition to affordable gas in the electric sector.

The new plan outlined in this report will require at least five major groups of stakeholders to be involved:

- Natural gas suppliers, including major producers and marketing groups, must be willing to offer viable, multi-year pricing agreements for a portion of their inventory; they must also be willing to share some of the risk of future price changes.

- Utilities and merchant generators must be willing to consider prudent, multi-year pricing agreements for a portion of their fuel needs; and they must be willing to share some of the risk of future price changes.

- Regulators and state governments must adopt a regulatory framework for the approval of prudent, long-term fuel-supply agreements that does not discriminate against natural gas. In addition, regulators must be willing to closely scrutinize any new short-term natural gas supply agreements and should reconsider the automatic pass-through of spot market fuel costs absent a showing that longer-term arrangements are not a more prudent course of action.

- Consumer advocates must be willing to support prudent, long-term natural gas supply arrangements before state regulatory bodies and legislatures where such arrangements, notwithstanding some price risks, can be expected to deliver significant long-term rate benefits.

- Natural gas pipelines and pipeline regulators must be willing to work with power plant operators to agree on appropriate transport tariffs for natural gas purchased under new, multi-year pricing arrangements.

We do not recommend that generators rely solely on long-term agreements for their gas requirements, nor should gas suppliers sell gas solely in these fashions. Instead, we believe generators and natural gas producers should supplement their current strategies with long- term agreements as a way to reduce costs and risks while increasing resource diversity and supply certainty.

This report presents the economic case for fuel switching based on three analyses: a “busbar” analysis of the comparative construction and operating costs of gas-fired plants vis-à-vis competitors; illustrative power plant retirement reviews based on different fuel costs; and a “minimax regret” analysis that evaluates risks associated with fuel procurement strategies, such as the innovative risk-sharing arrangements recommended in this report. Details of each analysis are provided in the appendices.